Getting to SOM – Serviceable Obtainable Market

In the last blog, we went over the metrics of market sizes, TAM SAM and SOM. We dug into how to think about TAM and SAM, and in this blog we’ll cover SOM.g. TAM, SAM and SOM are important to investors because it informs them of how large the potential is for your startup. If the max market is in the millions, and not billions, there is limited capacity for sales and therefore an exit. The Service Addressable Market limits the risk for investors as it lets them know what the near term potential is. With most (successful) startups being acquired or having an exit in about 10 years, the investor wants to know what a reasonable market capture is possible within that time frame. SOM, the obtainable market, is an even shorter view. SOM is your estimate of revenue in a time bound period, such as 3-5 or 5-7 years.

Getting to your SOM number is hard. It sounds simple, but that is deceiving. To make a good estimate of SOM, one has to do the hard work of financial projections and creating a marketing roadmap. In addition to the basic Cost of Goods Sold work required before starting your business, one has to make estimates about sales projections as well. This is assuming that the CoGS analysis has led to your initial pricing. It also assumes the founder knows where the first market will be and what it will cost to advertise in that market. That calculation should not be the only commercialization research done. As you plan to expand into new markets, the very same analysis done to arrive at COGS and overhead in your first market should be done for potential second and third markets. Some things to consider are:

- Rent: Do we need a new physical location, for services or distribution

- Personnel: Can we use our existing personnel or do we need to hire locals? What is the average wage for the people we need? Will hiring in another state cause an undue burden for reporting or taxes? How available are the staff we’ll need in this location?

- Advertising: What will it cost for advertising in this new market, using our favorite current channels?

- Market Potential: Having determined our ideal customer in our first market, how large is the opportunity in this market?

- Competitors: How well established are the competitors in this market? In some ways, having a competitor in the market is good. It establishes that there are customers willing to buy. If there are many competitors, it may be hard to penetrate the market.

- Regulations: Are there new regulations we need to meet? If so, at what cost? What are local licensing fees?

This analysis should be done for all potential follow-on markets. It will help to figure out which market should be your second/third/etc.

This market expansion exercise will take some time. I suggest selecting five markets to analyze so that the comparison is robust. There should also be a plan in place to understand when to consider expanding into new markets. As you penetrate your first market, it may seem obvious where your next market should be. Sales or reorders may appear to cluster in one location and it might be tempting to just start spending on advertising in that location, but the analysis should still be done. It may be that a visitor to your first market has returned home and talked about your product or service and caused a mini boom in that area. The good news is you have a champion in this new location, but do the analysis anyway to determine what the costs of pursuing that location as a second market will be.

The next thing to understand is WHEN. When should you expand to a second or third market? This will be a guessing game at the outset. You haven’t even penetrated your first market and you’re having to guess where your second market will be? We’ve done the work and have a roadmap for our follow-on markets, but when is it time to make the leap to the next market ? More financial analysis is in order.

There are a couple of ways to think about it. For example, sales could be your guidepost. When we get a certain level of organic sales in another market, then it may make sense to spend advertising dollars in that market to increase sales. If there is a large capital investment required to open a second market, then regardless of organic sales in the new market, it might make sense to have built up enough cash from the first market to be able to do the buildout and have enough cash to operate the second location at a loss for an extended period of time. Whatever amount of time you *think* it will take for that market to start paying for itself, it WILL be longer.

If we have a mobile technology and are first to market, then we must run faster and move to markets quickly. Do we have enough cash/credit/investment to do this? A similar analysis should be done to determine the cost of advertising in potential new markets and weigh that against the potential customers in a given market. It’s an art form not a science, and mostly guessing, but having done the analysis work, at least you can explain your thinking to a potential investor.

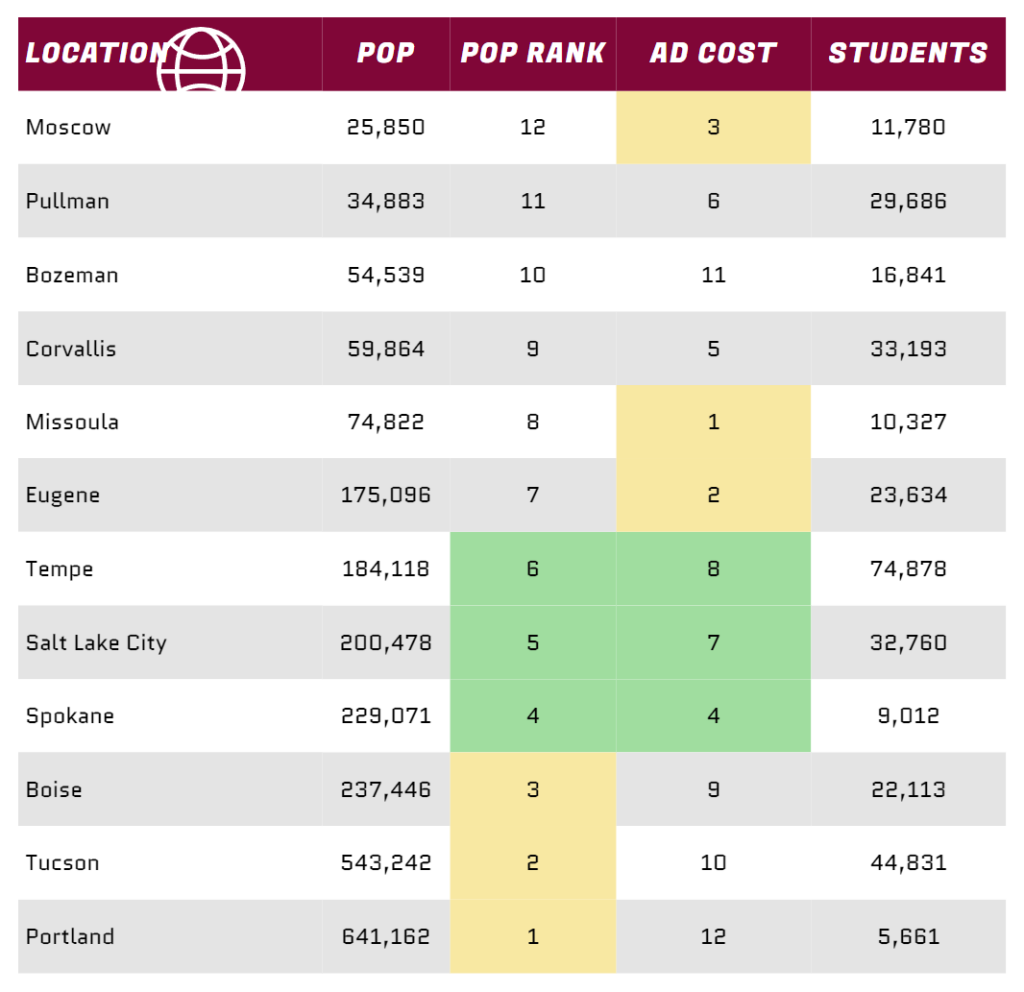

Here’s an example: A company has a food concept where two of the most popular cuisines can be ordered from the same location and delivered together, and they know that their best locations are college towns with a medium size city nearby. They start in Reno and do research to find next markets. They identify Salt Lake City, Missoula, Bozeman, Portland, Eugene, Corvallis, Pullman, Tempe, Tucson, Spokane, Moscow ID, Boise, Las Vegas. Portland and Las Vegas are larger cities than the others. Portland has two smaller universities that are 45 minutes apart, so a location between them might work. Las Vegas is quite spread out, but has a larger student population, which are primarily commuters. We’ll do the research, but think there are better markets than Las Vegas according to our ideal customer base. Performing the research on the other cities shows that the cost of advertising ranked lowest to highest is: Missoula, Eugene, Moscow, Spokane, Corvallis, Pullman, Salt Lake City, Tempe, Boise, Tucson, Bozeman, and Portland. Comparing that with population, we get:

Continuing with our research for Service Obtainable Market, look at the table to identify the next best market. In doing this research (note: I made up the ranks for ad cost) I ranked the population by highest to lowest, and the ad cost from lowest to highest. We want a low rank for ad cost and high rank for population. If we can find a 1-2-3 for ad cost and 12-11-10, that would be a good combination. That doesn’t work out. Continuing to seek the best combination, we have Spokane, ranked 4th in population and 4th in ad cost, so we’ll get more bang for our ad buck, reaching a greater number of people than the most populous cities. We should also look at student population. Spokane has Gonzaga University (7256), a WSU campus with 1600 students and UW Medical School with 159. The schools are located close to each other, so this seems like a very good second market. For Salt Lake City, only 16% live on campus, but there are housing neighborhoods very close to campus, so that seems like a very good third market. With the on-campus population and general spread of urban areas taken into account, Tempe may be more desirable if we can find a cooking location that is close to campus or the area where most students live. Some schools have very few on-campus dorms, so there may be more commuters. 22% of University of Arizona students in Tempe live on campus. Tempe may be a good fourth market, but we’ll have to revisit our research by the time we get to focusing on our 4th market.

As you can see, there is a lot of work to do to make a Market Roadmap, and while it will change over time, the research still needs to be done in order to arrive at SOM, your Obtainable Market. It should be done before you create your first investor pitch deck, and I submit once again that it should be done early for your own peace of mind. Is this business I’m starting one that will grow into the SAM and has potential to take a good percentage of the Total Addressable Market, or should I think in terms of dominating a single, first market?

Arriving at SOM – the Serviceable Obtainable Market is difficult, yet rewarding. After doing the research for Total Addressable Market and Service Available Market, the very thoughtful process of getting to SOM is time consuming and entails many small decisions that lead to a plan. Having gone through the basic financial information and then analyzing where and when secondary markets may be established should give a founder a thorough understanding of their industry, expenses and a good idea of a timeline for expansion. SOM – it’s not just for investors!

YouTube video of TAM SAM SOM Overview with good and poor examples.