Post Money Startup Valuation Calculator

How To Come Up With a Fundable Number

StartUpNV Valuation Calculator

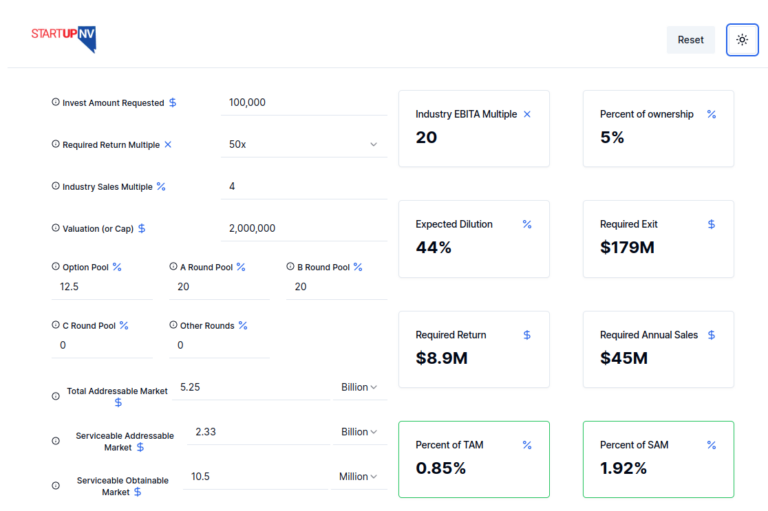

TLDR? Click here to register and use our startup valuation tool. Register once, bookmark it, and come back anytime (no log-in required).

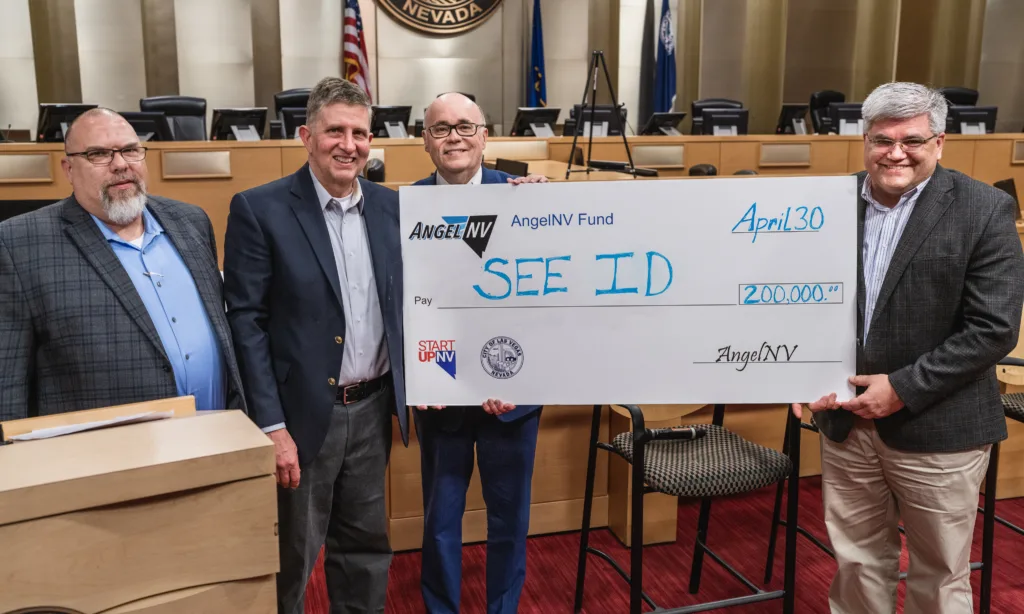

Each year between StartUpNV, FundNV, AngelNV, 1864.Fund, the Sierra Angels, and our syndicate, we see thousands of pitches, decks, and applications for venture capital funding. We take a closer look at a few hundred that appear to fit our thesis and often find ourselves asking – “how’d you come up with that valuation?”

We rarely get a well informed, defensible answer. Rather than continuing to ask, we created a tool so we could calculate as objective an answer as possible. Now, when founders ask “why’d you pass?”, we share our research and calculations. Our “pass” discussions have become real eye openers for founders. Based on those reactions we decided to “productize” our first level due diligence tool for founders, investors, students, and the community. The tool demystifies our most basic analysis around post-money valuation so both founders and investors can win. It’s just one piece of the overall decision making process, but it is an important one.

Try out the calculator!

Our startup company valuation calculator is designed to help founders and investors align on a post-money valuation or post-money valuation cap that can be objectively justified by current market factors, such as an Acquisition Sales Multiple (ASM) for similar companies, researched market sizing for Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and the top line sales amount to achieve the specified Exit Multiple Requirement (EMR) for an investment from pre-seed to seed to an A round and beyond.

We want founders to understand that our EMR at pre-seed is 50x in 10 years; at seed it’s 40x in 8 years; and at an A round it’s 20x in 5 years. Why? Are we just greedy bastards? Well maybe, but it’s really about portfolio management. Out of a portfolio cohort of 20 startups, with everyone having the best intent, 13-15 companies will fail and return no capital. 3-5 companies will return some capital. Leaving 1 or 2 companies to return the fund at a minimum of 3 times, preferably 5 times or more. If each company isn’t capable of hitting the 30-40-50x EMR, the “fund math” doesn’t work.

Important Features to Understand

- Acquisition Sales Multiple (ASM) – what are similar companies being acquired for as a multiple of their sales

- TAM – Total Addressable Market for your LIKELY or reasonable market. If you’re selling a specialized insurance product – or a SaaS product that serves an insurance niche, your TAM is not all insurance bought in the world. Research the proper number! For more guidance finding your TAM/SAM/SOM, check out our how-to video here.

- SAM – Serviceable Addressable Market. Follows the same “reasonable” logic as TAM, but for a subset, for us it’s often the US portion of a global market. Using the ASM, we look hard at what percentage of the SAM company sales must be to achieve our EMR.

- SOM – Serviceable Obtainable Market. This is your 3 year bottom-up sales forecast. It should not be a percentage of the SAM – no matter how “conservative” you think your percentage is. The tool does not use this number in the calculation, but it is contextually informative compared against the sales required to achieve the EMR.

- EMR – Exit Multiple Requirement. It is the number of dollars required at exit for each dollar invested. This number varies based on the stage of investment and likely timeline to see capital returned (less fees). Remember that for 100+ years, investors can return 2x over 8-9 years by investing in a low risk index fund in the public stock market. Venture returns must be much higher for the risk taken in venture capital investments.

- Dilution Percentage. How much of your company do you plan to sell at each subsequent round – including a percentage of the company that will be set aside for employee options and other grants.

- Investment Amount Requested – what is the total amount requested for the round.

- Valuation or Valuation Cap – the POST-money valuation for the round. Pre-money is not helpful to the valuation calculator. If your round is $500k and your pre-money is $5M, then your post-money is $5.5M – use that POST-money number to calculate.

Try Out The Calculator

Why is a valuation tool necessary?

The Angel Capital Association recommends the following 4 methods:

- Venture Capital Valuation Method.

- Scorecard Valuation Methodology.

- Dave Berkus Valuation Method.

- The Risk-Factor Summation Method.

While these are good comparison points, we prefer to use more objective and current market facts. We conduct research via Crunchbase, Pitchbook, and other research tools on

- Similar companies’ Exit Multiples: Don’t choose the best one ever.

- Understanding “reasonableness” of TAM/SAM claims

- Understanding the sales target to achieve our required exit

- Understanding the % of TAM/SAM required to hit the sales goal

- Does the return require a 20% TAM sales achievement or 3% of SAM?

- Seeing the SOM in context with the required sales goal. How close does the “standard” triple-triple-triple-double-double sales growth model get us to an exit. Are the bottom up sales growth numbers rational for the market?

Others might ask “what about a 409A valuation?”. This method requires outside evaluators and is for investments much further along than the pre-seed, seed and A rounds in which we invest.