TAM SAM SOM Examples

In this article, StartUpNV will walk you through the process of understanding market research and sizing, while giving you excellent tam sam som examples to get your pitch looking perfect.

Understanding Market Sizing

Determining market size is hard, and we know that! Market sizing involves quantifying the demand for a product or service in a given market. It helps you answer key questions, such as:

- How big is the market for my product or service?

- What is the revenue potential?

- How much market share can my business capture?

- Is there room for growth in this market?

These questions are especially crucial for startups and businesses planning to introduce new offerings, as they provide valuable insights for business strategy, investment decisions, and marketing planning. You’ll learn more as we dive into tam sam som exampes.

The Role of Market Research

Market sizing is not a mere estimate or guesswork; it requires a systematic approach grounded in data and research. Market research is the foundation of market sizing, as it helps you gather the necessary information and data points to make informed decisions.

Market research can be conducted using primary and secondary sources. Primary research involves collecting data directly from potential customers, surveys, focus groups, and interviews. Secondary research, on the other hand, relies on existing data sources, such as industry reports, government publications, and academic studies. Both methods are valuable for building a comprehensive understanding of the market.

In the sections that follow, we’ll delve deeper into the three essential market sizing metrics: TAM, SAM, and SOM. We’ll discuss what each term means, how to calculate them, and provide real-world examples to illustrate their application.

Total Addressable Market (TAM)

Defining TAM

Total Addressable Market (TAM) represents the entire potential market for a specific product or service, assuming there are no limitations or competitive factors. It’s the “big picture” of market size, encompassing all potential customers or users who could benefit from what you offer.

TAM can be thought of as the theoretical upper limit. It is an important starting point for market sizing because it helps you understand the full scope of the market opportunity.

How to Calculate TAM

Calculating TAM involves several steps:

- Define Your Market: Clearly define the market in which your product or service operates. This could be a geographical region, a particular industry, or a specific customer segment.

- Identify Potential Customers: Determine who your potential customers are and how many of them exist in the market. This often requires a mix of primary and secondary research to gather data on the target audience.

- Assess Market Demand: Understand the demand for your product or service. What pain points does it address, and how many people or businesses experience these pain points in the market?

- Calculate Market Size: Once you have identified your potential customers and their demand, multiply the number of potential customers by the price they are willing to pay for your offering.

- Adjust for Growth: Consider the potential for market growth over time, which could be influenced by factors like industry trends, economic conditions, or technological advancements.

Total Addressable Market (TAM) Examples

To illustrate the concept of TAM, let’s consider a few real-world examples:

- Smartphones: The TAM for smartphones is vast, encompassing the global population. However, it’s crucial to segment this market based on factors like operating systems, demographics, and regions to arrive at a more realistic TAM.

- Electric Vehicles (EVs): The TAM for electric vehicles includes all potential car buyers worldwide. Companies like Tesla segment this market by focusing on electric car enthusiasts, luxury car buyers, and specific regions.

- E-commerce: The TAM for e-commerce is determined by the number of people who shop online. Companies like Amazon segment this market by product categories, such as books, electronics, and clothing.

TAM provides a comprehensive view of the market potential, but it’s essential to remember that not all of this potential is attainable, which leads us to the next concept: Serviceable Addressable Market (SAM).

Serviceable Addressable Market (SAM)

What is SAM?

Serviceable Addressable Market (SAM) is a more refined subset of TAM. It represents the portion of the total market that your business can realistically target and serve effectively. In other words, SAM narrows down the market to your ideal customers within the TAM, considering factors like your business’s capabilities, resources, and strategy.

SAM is a critical concept for businesses because it helps in setting realistic goals and expectations, focusing marketing efforts, and planning resource allocation more effectively.

SAM Calculation Methods

Calculating SAM involves a more in-depth analysis than TAM:

- Define Ideal Customer Profiles: Identify the characteristics and attributes of the customers who are most likely to purchase your product or service. This might include factors like age, income, location, and specific needs.

- Market Segmentation: Segment the TAM based on your ideal customer profiles. This can result in a smaller, more refined subset of potential customers that align with your business strategy.

- Competitive Landscape: Analyze the competition in your SAM. Consider how other businesses are targeting the same customers and assess their market share.

- Adjust for Limitations: Take into account any limitations or constraints your business may have, such as production capacity, distribution channels, or marketing budget.

- Quantify SAM: Calculate the number of potential customers in your SAM and estimate their willingness to purchase your product or service.

Serviceable Addressable Market Examples

To understand SAM better, let’s explore a few examples:

- SaaS (Software as a Service): A SaaS company providing project management software might define its SAM as medium to large-sized businesses in the technology sector. This is a subset of the broader software market.

- Healthcare Services: A healthcare provider specializing in pediatric care may define its SAM as families with young children in a specific city or region.

- Coffee Shop: A local coffee shop’s SAM could be the population within a 10-mile radius of its location.

By focusing on SAM, businesses can tailor their marketing strategies and allocate resources more effectively, leading to a higher probability of success. However, to achieve meaningful market share, businesses need to consider yet another layer of market sizing: the Serviceable Obtainable Market (SOM).

Serviceable Obtainable Market (SOM)

Explaining SOM

Serviceable Obtainable Market (SOM) represents the portion of the Serviceable Addressable Market (SAM) that your business can realistically capture based on your strategy and resources. While SAM identifies the potential customer base, SOM delves deeper to evaluate how much of that market you can actually win over.

SOM is where market sizing becomes truly actionable. It’s about setting specific, achievable goals and strategies to secure a share of the market.

Factors Affecting SOM

Several factors impact your SOM:

- Competitive Advantage: Assess your unique selling points and competitive advantage. How does your product or service stand out in the market?

- Marketing and Sales Capabilities: Evaluate your marketing and sales efforts. Can you effectively reach and convert your target audience?

- Resource Allocation: Consider your budget, personnel, and infrastructure. Do you have the necessary resources to serve your SOM?

- Market Trends: Keep an eye on market trends and customer preferences. Are there shifts that can affect your SOM?

- Market Entry Strategy: Determine your market entry strategy. Will you start small and expand gradually, or aim for rapid growth?

Serviceable Obtainable Market Examples

Let’s look at some examples to illustrate SOM:

- Fast-Food Restaurant Chain: A fast-food chain’s SOM could be the percentage of the local market it can capture based on its menu, pricing, and marketing efforts. It might aim for 20% of the fast-food market in a specific city.

- Software Startup: A software startup targeting the project management sector may focus on capturing 10% of its SAM within the first year of operation.

- E-commerce Store: An e-commerce business specializing in handmade jewelry might set a goal of securing 5% of its SAM within the first two years.

By identifying and actively pursuing your SOM, businesses can create strategic plans, allocate resources effectively, and work towards sustainable growth. As we continue through this article, we’ll delve further into the practical application of these concepts, real-world case studies, and the tools available to aid your market sizing efforts.

TAM SAM SOM Differences

Key Distinctions Between TAM SAM and SOM

Understanding the differences between Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) is essential for effective market sizing and strategic planning. Here, we highlight the key distinctions between these three critical metrics:

- Scope:

- TAM: TAM represents the entire potential market for a product or service, regardless of limitations or competition.

- SAM: SAM is a subset of TAM, focusing on the portion that aligns with your business capabilities and strategy.

- SOM: SOM is the smaller portion of SAM that your business can realistically capture based on resources, competition, and strategy.

- Ideal Customer:

- TAM: TAM considers all potential customers in a market.

- SAM: SAM narrows it down to the ideal customers your business can serve effectively.

- SOM: SOM is about setting specific, achievable goals to secure a share of the market.

- Actionability:

- TAM: TAM is more theoretical and strategic, helping you understand the market’s full potential.

- SAM: SAM is where market sizing becomes actionable, allowing you to target your ideal customer base.

- SOM: SOM is highly actionable, focusing on specific goals and strategies to capture a share of the market.

- Resource Consideration:

- TAM: TAM does not consider resource constraints.

- SAM: SAM accounts for your business’s capabilities and resources.

- SOM: SOM delves even deeper into resource allocation, focusing on what you can realistically achieve.

- Strategy:

- TAM: TAM informs high-level business strategy and market entry decisions.

- SAM: SAM guides marketing and resource allocation decisions.

- SOM: SOM is about setting specific targets and strategies to achieve them.

- Realistic Market Share:

- TAM: TAM doesn’t provide a clear path to attainable market share.

- SAM: SAM narrows down the market and helps in setting realistic market share goals.

- SOM: SOM focuses on specific market share targets, making it easier to measure success.

By understanding these distinctions, you can better utilize TAM SAM and SOM to drive your business strategies and make informed decisions.

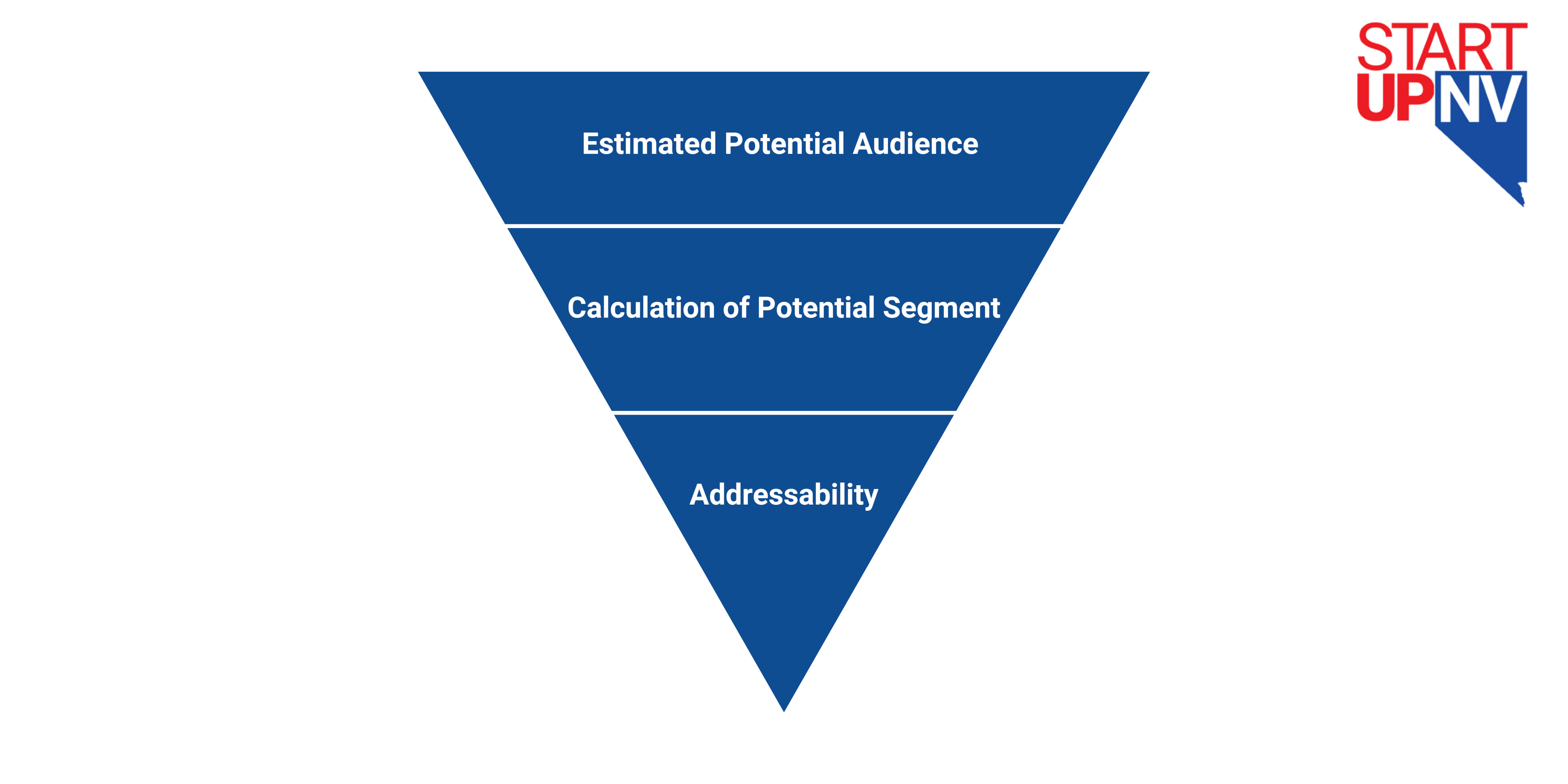

Market Sizing Methods

Top-Down Approach

Market sizing typically involves two main approaches: the top-down approach and the bottom-up approach. Let’s explore both:

Top-Down Approach:

The top-down approach starts with the Total Addressable Market (TAM) and then refines it by applying assumptions and segmentation. It often relies on industry reports, government data, or existing market research. Here’s how it works:

- Identify TAM: Begin with an estimate of the TAM for your product or service. This might be a broad market estimate.

- Segment TAM: Break down the TAM into segments based on factors like demographics, geography, or customer behavior.

- Apply Assumptions: Apply assumptions to refine the estimate. For example, if you’re launching a new mobile app, you might consider the percentage of smartphone users in your target region.

- Calculate SAM and SOM: Using these assumptions, calculate your Serviceable Addressable Market (SAM) and your Serviceable Obtainable Market (SOM).

The top-down approach is useful when you have limited data but can rely on industry trends and existing market research.

Bottom-Up Approach

Bottom-Up Approach:

The bottom-up approach, on the other hand, starts with specific data points and builds up to create a market estimate. It’s often preferred when you have direct access to customer data or when starting from scratch with a new product or service. Here’s how it works:

- Identify Specific Data Points: Begin with concrete data points, such as the number of customers you have or the demand you’ve observed in a specific segment.

- Expand to SAM: Use these data points to estimate your Serviceable Addressable Market (SAM) by extrapolating to a larger audience.

- Refine and Validate: Continue refining your estimates as you gather more data, and validate your findings through primary research or surveys.

- Calculate SOM: Based on the refined data, determine your Serviceable Obtainable Market (SOM).

The bottom-up approach is highly data-driven and allows for more precise market sizing. It’s especially useful when entering new, niche markets or when you have direct access to customer information.

Primary and Secondary Research

Both approaches can benefit from a combination of primary and secondary research:

- Primary Research: Involves collecting firsthand data through surveys, interviews, focus groups, or direct customer interactions. This approach is valuable for refining estimates and understanding customer needs.

- Secondary Research: Relies on existing data sources like industry reports, government publications, academic studies, and market research databases. Secondary research provides a foundation for market sizing, especially when detailed data is scarce.

The choice between the top-down and bottom-up approaches, as well as the mix of primary and secondary research, depends on the availability of data, the complexity of your market, and the level of precision required.

In the next sections, we’ll delve deeper into tools and resources available for market sizing and explore industry-specific considerations for different markets.

Tools and Resources for Market Sizing

Market Sizing Tools and Software

Accurate market sizing often requires specialized tools and software to gather, analyze, and interpret data. Here are some tools and resources commonly used in market sizing:

- Market Research Platforms: Platforms like Statista, IBISWorld, and Nielsen provide industry reports, market data, and consumer insights to help in market sizing.

- Customer Relationship Management (CRM) Software: CRM software, such as Salesforce or HubSpot, can be used to track customer data, preferences, and buying behavior, which is valuable for market sizing.

- Data Analysis Tools: Tools like Microsoft Excel, Google Sheets, and more advanced data analysis platforms can help process and analyze market data.

- Market Research Surveys: Tools like SurveyMonkey and Typeform facilitate the creation and distribution of surveys to gather primary data from potential customers.

- Geographic Information Systems (GIS): GIS software, such as ArcGIS, aids in mapping and spatial analysis, allowing for geographic segmentation in market sizing.

- Competitive Intelligence Tools: Platforms like SEMrush and Ahrefs offer insights into competitor strategies and market trends.

- Market Sizing Software: Specialized software like QuickMVP or G2 Crowd can help in estimating market size using various market research techniques.

Comparative Analysis

When selecting the right tools and resources for your market sizing project, it’s essential to conduct a comparative analysis. Consider factors such as data quality, ease of use, cost, and the specific features that align with your market sizing goals.

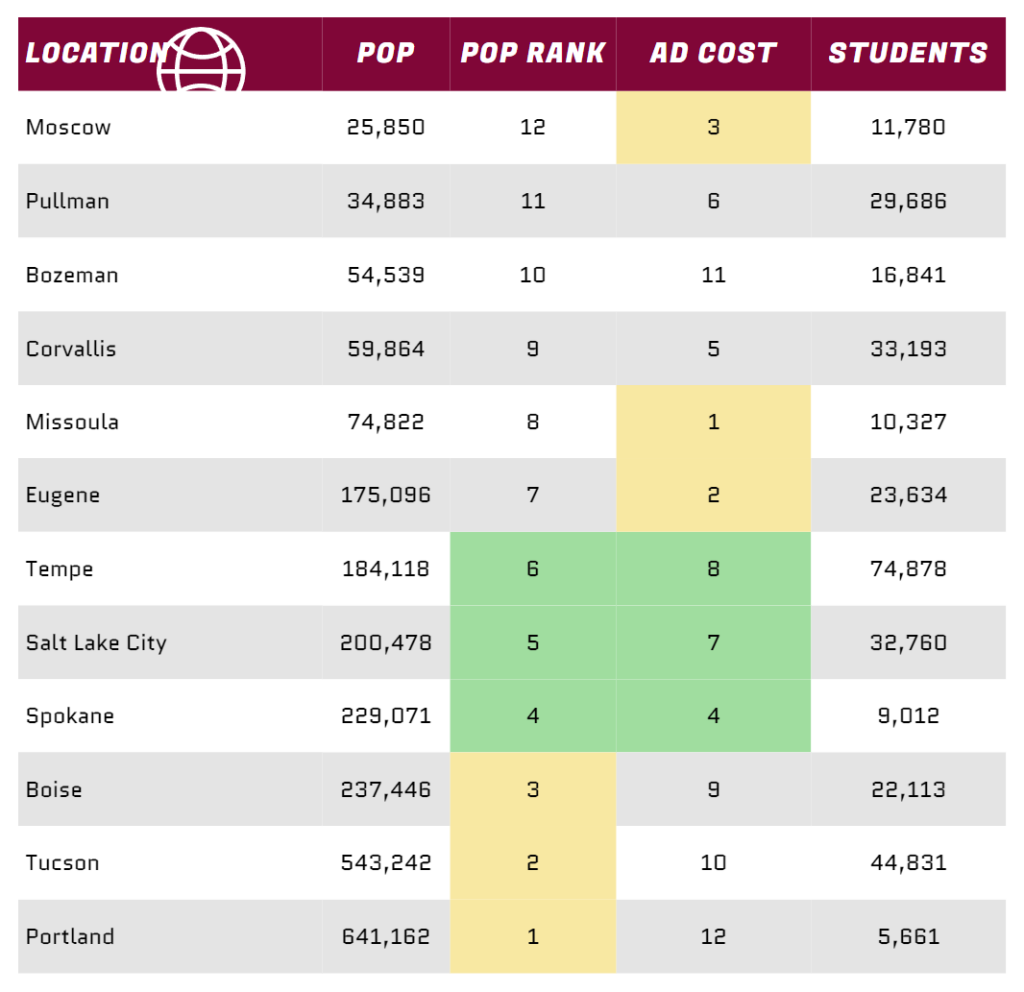

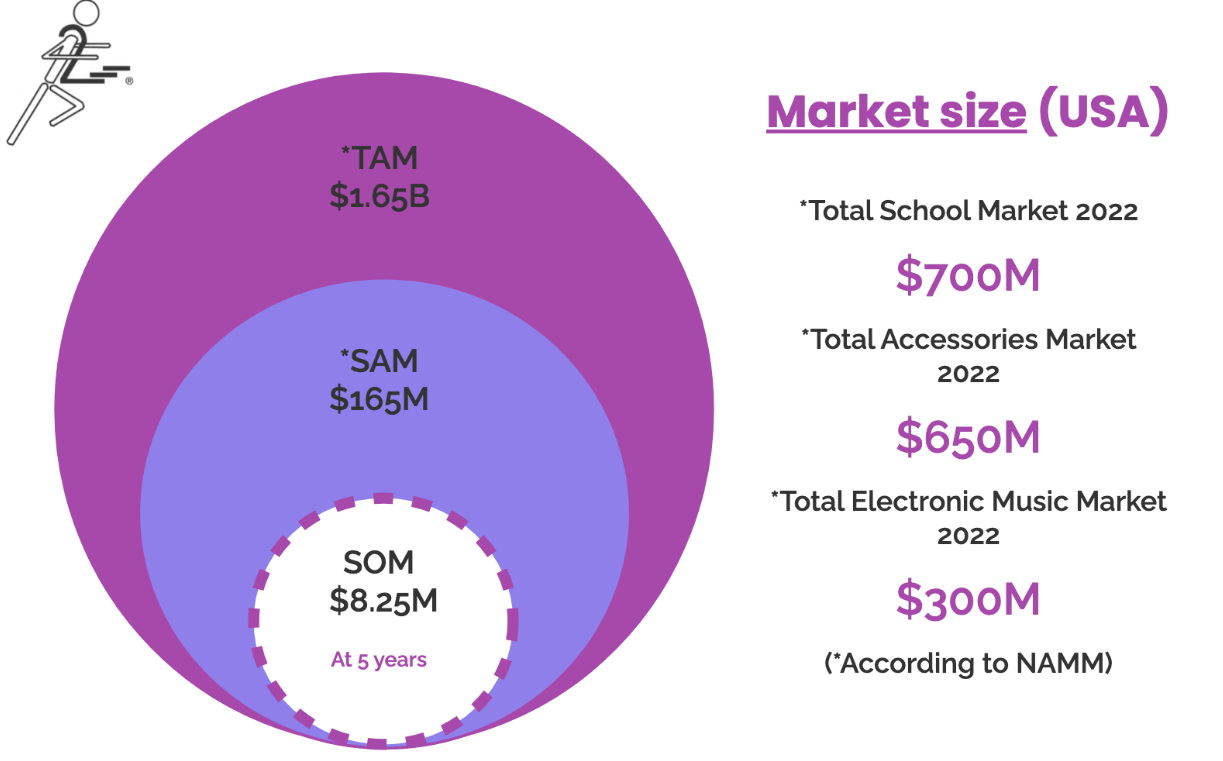

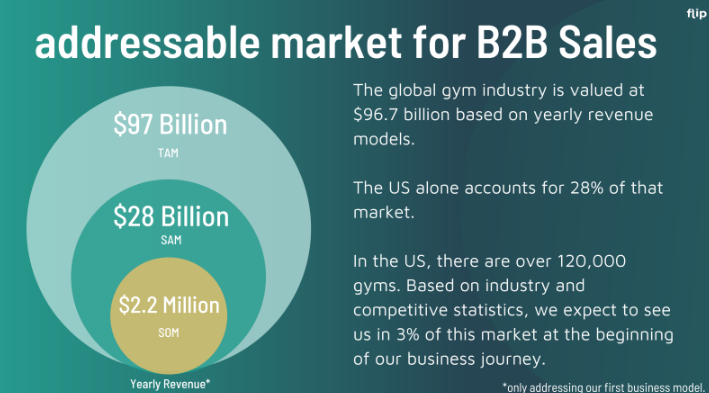

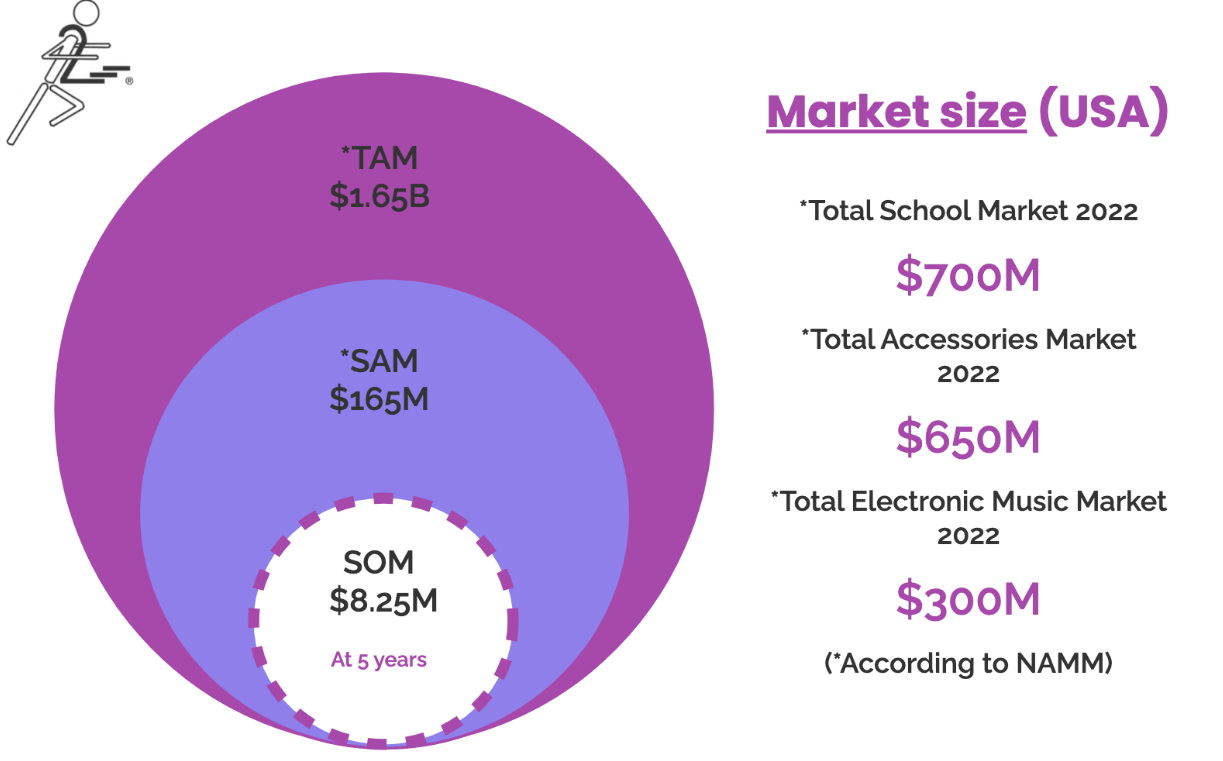

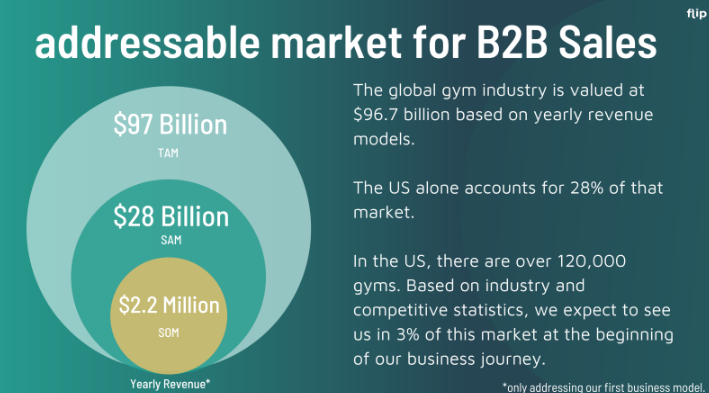

TAM SAM SOM Example

These are all great examples of TAM SAM SOM. They realistically captured external research data from market reports and shown that their entire market, from total available market, to serviceable addressable market, and finally serviceable obtainable market are all highly intentional numbers, looking to maximize on funding opportunities from investors.

Conclusion

In the world of business, understanding market size is like having a compass that guides your journey. It’s the foundation upon which successful strategies are built, investments are made, and growth is achieved. The concepts of Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) provide a framework to navigate the complex landscape of market sizing.

TAM offers a panoramic view of the market’s potential, SAM narrows it down to your ideal customers, and SOM sets concrete goals for your market share. These metrics empower businesses to make informed decisions, allocate resources effectively, and develop targeted marketing strategies.

As we’ve explored in this article, market sizing is not a one-size-fits-all process. It requires data-driven approaches, a combination of primary and secondary research, and, in many cases, the use of specialized tools and software. Whether you’re a startup entrepreneur looking to make your mark, an established business planning expansion, or an investor seeking opportunities, market sizing plays a crucial role in your journey.

Market sizing is an ongoing process. Market conditions change, and it’s essential to reevaluate your TAM, SAM, and SOM periodically to adapt your strategies accordingly. By staying attuned to shifts in your target market and continuously refining your approach, you can maintain a competitive edge and capitalize on evolving opportunities.

In the dynamic world of business, the ability to calculate market size using TAM, SAM, and SOM is a fundamental skill. It provides the clarity and direction needed to make confident decisions, set realistic goals, and chart a path toward sustainable success.

So, as you embark on your business endeavors, remember that understanding and applying market sizing concepts is not merely a part of your strategy—it is your strategy.

Thank you for reading this guide on calculating market size using TAM SAM SOM. We hope it empowers you to navigate the complexities of the business world and reach new heights of success. Please give us your feedback on all of the tam sam som example!

Interested in learning how to value your company? Click here!