How To Win A Startup Pitch Competition

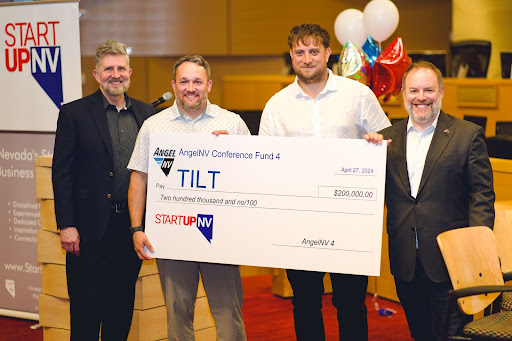

Winning a pitch competition is an exciting accomplishment for a startup, even if an investment doesn’t immediately follow. It means the company has convinced judges that it has a compelling idea, large market opportunity, and an experienced team to bring the product or service to market successfully.

The Basics

Winning a pitch competition is not the same thing as getting an investment. The goal is different; as is the way it is presented. Knowing who the judges are is an important element in planning the strategy. If the judges are investors, then the pitch should be similar to one that would be presented to them. If the judges are other founders or people from entrepreneur support organizations, another strategy is called for. If the judges are from an organization that is sponsoring the event, depending on what their business is, a completely different strategy is needed.

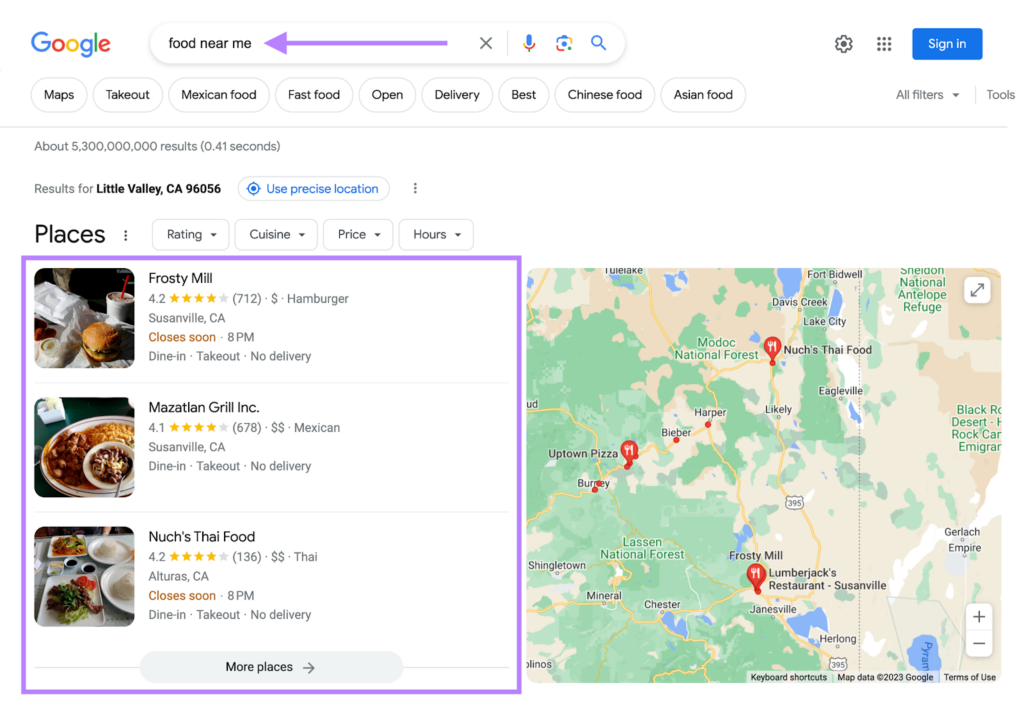

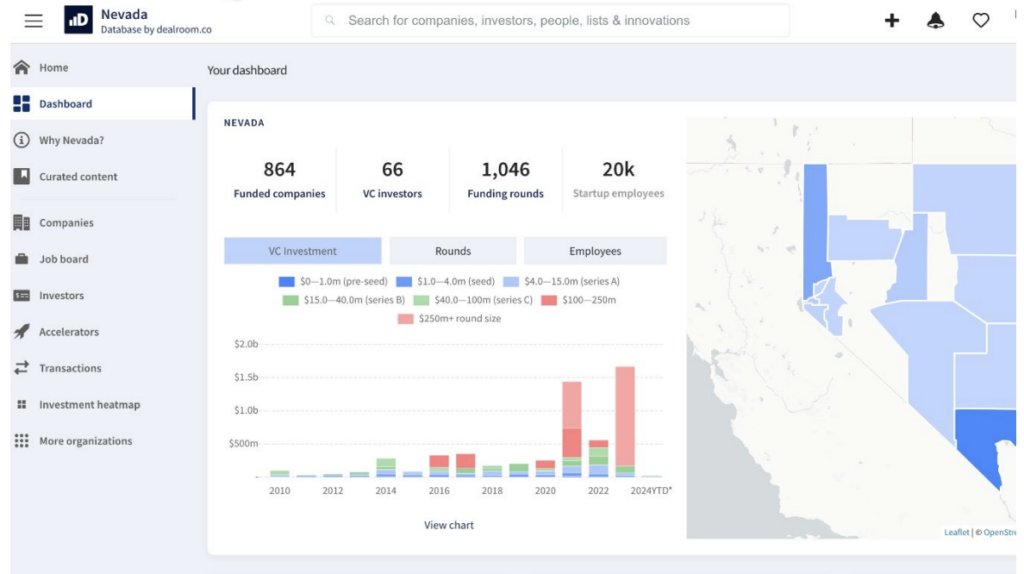

For all of the above audiences, it is assumed that the pitch competition is being held in front of an audience, probably in a large room. In this situation, the slides should be engaging with photos or graphics that are easily discerned. If charts are used, they should also be large enough to be seen from the back of the room.

The pitch competition is a performance. It should be exciting! The presenter should be confident and want the attention to remain on his voice and persona, with the slides serving as enhancements to the story he is telling. And it is a story. It should have a beginning, middle and end. The story is about what the company does that is amazing and saves people time, money, sorrow, lives, or making people happy.

Let’s assume there is a 10-minute time limit. Ten minutes is enough time to tell the audience why the company was started, who started it, how the product or service works, what industry the company fits into, how the company will attract the people they are helping (customers), why the company will be successful, the impact it is currently having, and how an investor can play an important role in bringing the solution to others.

We’ll take each necessary slide in turn, but first let’s set the stage…

In a pitch competition, there will be several pitches in the lineup. Going first or last is desirable because the first pitch is when people are the most focused and the last pitch leaves an impression with the judges. The in-between pitches must stand out to be remembered by the audience at large. The goal is that the judges are taking the competition seriously and taking copious notes to recall what they liked or not about each pitch. Even the serious, dedicated judge will have his/her attention flag if there are more than 4 pitches to score. It’s inevitable. The middle presenters must do what they can to capture the attention of the judges and keep it for the duration of the pitch.

Understand that this is a performance. Do actors write a script and then go out and perform it for the first time in front of an audience? They do not. They practice and rehearse. They tape themselves and ask for input. They memorize the lines and then practice the intonations and the gestures they will use. They practice movement. They have marks on the floor to hit for certain points. This applies equally well for a pitch presentation. First, hone the slides. Then practice the script. Yes, it’s a script. Script it all: the pauses, the jokes, the pregnant pauses; all of it.

Practice 10 times by reading it, without slides. Practice 10 times in front of a mirror, without slides. Practice 10 times with the slides. Record the 11th time. Go perform it in front of a critical judge (no mothers please). Ask what they liked or not. Ask them to summarize what your product does and who it helps. Ask what was the best part; what was the worst part, hardest to understand or seemed disjointed. Now, go view the recording. Does what your “judge” critiqued as rough parts show as rough parts in the recording? Can you match what the person said to the recording? Can the script be changed to add clarity, humor or understanding? If so, do it then practice again, first reading, then in front of the mirror and then with the slides. Record yourself again. Practice a minimum of 40 times prior to pitch day.

To stand out and win, a pitch needs to tell an engaging story that paints a clear picture of the problem the startup is solving, why it’s important, and how its solution works. Simply reciting facts and figures is a surefire way to lose the judges’ attention. Most founders start a company because they have experienced some pain point and want to solve it for themselves. This is a good starting point for the story of why the company was created and the people it will serve. There should be some drama in the origin story, so if it didn’t naturally have drama, edit the story so that it does. Saying that “I could never send my large files through email and hated breaking them into smaller files” is much more boring than “I kept having to send large files to other tech companies and it was costing me an arm and a leg and 2 days to have a courier pick up a drive and deliver it to the customer, so I created an online place with unlimited storage and made it easy for others to access my files. That’s DropBox. One is completely accurate, the other paints a picture. Work on creating a vibrant picture of the problem, and the solution.

Let’s get into the key slides of a pitch deck…

The Problem

The presenter should start by vividly describing the problem the startup is solving in a way that resonates emotionally with the judges. They want the judges feeling the pain and frustration their target customers experience. The best problems to solve are big, obvious “gushing artery” type issues rather than minor “paper cuts.” The audience should be able to see the slide and recognize the problem. If it’s a technical problem, the problem should include how much time/money is wasted because the brilliant solution has not existed in the market yet. The problem is only one slide, two at most. If the problem cannot be made clear in two slides, it is not a big enough problem to spend time solving.

The Solution

Once the problem is clear, the startup’s solution should be explained in a straightforward, easy-to-understand way. If there were 3 parts to the problem, the solution should address each one of them.

Now the story can be finished and the startup takes the hero role by providing the solution to the story that ended in frustration at the top of the pitch. Warning: Do not show screenshots, do not show graphs for this. Tell the audience how it works, do not show the steps. Instead, show the happy users of the solution.

The Market

The pitcher needs to convince the judges there is a massive market opportunity by quantifying the total addressable market size with credible third-party data. Investors are used to hearing about TAM SAM and SOM. TAM is the total addressable market and it should be a researched number. This is the total amount being spent in the world for this industry. SAM is the Serviceable available market, and is a subset of TAM. This also should be a researched number. It will often be the beachhead market the company intends to attack. If the TAM is worldwide sales in an industry, SAM will often be the US market. Finally, SOM is the Obtainable Market and is a projection of Revenue in a time bound period, say 5 to 7 years. SOM is hard because it involves sales projections, but more than that it is forward looking at how the business will grow and what markets it will attack second and third. It involves making an estimation of how much revenue the first market should be generating before attacking the next market. There is a lot of research to be done to get to a reasonable SOM. A slide that shows a percentage of SAM or TAM is evidence that the founder has not done the research necessary to plan for business growth and has not done enough analysis to understand where his first several markets are located.

The Business Model

How will the startup make money? The primary way the product is sold should be clear. It is Business to Business, a SaaS, software as a service model or Direct to Consumer. If the product is sold only to the government, it should be clear. This slide should show what the customer pays for the product, costs if it is a physical product and any tiers of pricing.

Traction

Traction is revenue. Anything else is milestones. While milestones are better than nothing, judges will be most impressed by real customer traction and revenue. If the startup has sales to highlight, no matter how modest, the slide should include this information. If the founder knows the CAC, cost to acquire a customer and LTV, lifetime value, it should be on this slide. LTV takes a longer time to establish than the cost to acquire a customer, but this can be noted in narration and a guess can be made as to the number of years the company will retain its customers. Please focus on paying customers rather than downloads or other stats that make the founder feel good, but not an investor.

The Team

Investors invest in the jockey, not just the horse. If the team has founders who have had exits or acquisitions, the slide may be presented earlier than normal. Because investors do invest in the jockey, if the founders have had successful exits, this will cause immediate interest by the investors. If the judges are lay people, it may not. The team slide should have pictures of the founding team. It should include the role each person has within the company, and a few bullet points for each team member that show accomplishments, banner former companies or great institutions. Including logos instead of names of institutions is more interesting and space saving. The purpose of the slide is to create faith that this team of founders can be successful with this company. If the founders are young, they may include up to two advisors, as long as the advisors have given consent and actually do have regular meetings with the founders.

The Ask

If seeking investment, the Ask slide should be very specific about the amount, investment vehicle, and terms. The vehicle can be debt, a convertible note with a discount (or not) and valuation cap, a SAFE (Standard Agreement for Future Equity) or a priced round of shares. Most of these have a component that suggests the current valuation of the company. This should be on the slide and not left to the imagination. When pitching to investors, it absolutely must be on the slide, or the investors will think the company is hiding something. Use of Funds should also be on the slide as either bullets or a pie chart with amounts of the raise and where and to what the funding will be allocated. One bullet can show the length of the time the funding is planned to carry the startup forward. In narration, milestones the funding will achieve can be shared.

The Close/Thank you

As the last slide is visible, the presenter should tie the opportunity back to the original problem and reiterate in a memorable way by rallying the audience around the startup’s vision for change and the bright future it will create. The last slide should have the logo, “Thank You”, and contact information. The pitcher should make sure to include contact info at the end so investors can easily follow up.

Above all, the pitcher should practice diligently, watch their pacing and timing, create visually impactful slides, and bring relentless energy and enthusiasm to the pitch. By nailing the key elements above in a compelling presentation, a startup will bolster its chances of winning over the judges.

Written by Maggie Saling, COO of StartUpNV

How To Win A Startup Pitch Competition Read More »