Unlocking The Secrets On How To Become An Investor In Startups

Startups have become increasingly popular investments in recent years. With the potential for huge returns, it’s no wonder why people are looking to invest in these new and innovative companies. However, investing in startups is a risky proposition that requires careful consideration of the risks and rewards involved.

Many startup companies offer investors the chance to buy into their businesses at discounted prices, exposing them to potentially explosive growth if they hit it big. In this article, we’ll explore how to become an investor in startups and how you can use this strategy to create wealth while minimizing your risk profile.

Definition Of Startup Investing

Startup investing is an investment strategy encompassing venture capital, angel investing, and equity crowdfunding. It involves buying shares or interest in a company that is not publicly traded but has growth potential. Startups are recently founded companies that usually require additional funds to grow their business operations, products, and services. By investing in startups, individuals can acquire a stake in the firm’s future success.

Investing in startups comes with its own set of risks due to their typically high failure rate. Companies may fail because they lack experience, resources, or market demand for their product/service. However, those who invest early stand to gain greater returns than investors who join later funding rounds when the company already has some traction and stability. it takes both knowledge of markets and intuition about promising technologies and businesses to identify opportunities worth pursuing.

Potential For High Returns

Startup investing offers investors a potentially lucrative opportunity to reap high returns. With the right investment strategy and an eye for spotting promising startups, it is possible to have access to significant economic growth potential. By leveraging this type of early-stage investing, investors can experience greater capital appreciation than traditional investments like stocks or bonds. This could be because startup companies often offer higher risk-adjusted return opportunities as they come with more volatility and reward potential.

In addition, many investors are increasingly turning to startup investing because of its diversification benefits. Investing in startups provides a unique avenue for building wealth outside traditional asset classes such as stocks and real estate, which may not grow at the same rate or provide sufficient diversification benefits across sectors and geographies. It allows investors to gain exposure to innovative business models that are generally unavailable through other conventional investments.

Moreover, by including venture capitalists and private equity firms in their portfolio mix, investors can tap into insights from some of the brightest minds in finance who understand how best to identify attractive deals and manage risks associated with early-stage investments.

Diversification Benefits

Another benefit of investing in startups is diversification. Most traditional asset classes—like stocks or bonds—are subject to market volatility and risk; however, early-stage investments carry less risk than those found on public markets due to their smaller size and shorter time horizons for success or failure. By diversifying your portfolio, you can spread risk across different types of investments while reaping the potentially high returns associated with early-stage venture capital investments.

These types of investments tend to spread risk among multiple sectors since many venture capitalists invest in a wide range of start-ups from different markets or economic sectors. As such, a well-diversified startup portfolio will have more options and less risk exposure compared to investing exclusively in one sector. Additionally, venture capitalists often hedge against market volatility by taking ownership stakes in multiple startups at once, which also reduces their overall risk profile.

By understanding how diversification benefits both individual investors and venture capitalists alike, it becomes easier to see why this form of investing has become increasingly popular over recent years. With careful planning and research into each company’s unique characteristics, investors may be able to maximize their profits while minimizing risks associated with any one particular investment decisions.

Risk Management Strategies

Investing in startups can be a risky endeavor, but the potential rewards are substantial. It is important to have an effective risk-management strategy in place before investing in any venture. According to Forbes, nearly 40% of startup investments fail within five years due to inadequate planning or insufficient capitalization. As an investor, it’s essential to understand how best to protect your portfolio against market volatility and reduce exposure to risk.

One key investment strategy for mitigating risk is diversification. By investing across different industries, stages of development, and geographies, you’ll build a more robust portfolio that will better withstand economic downturns and industry disruptions. Additionally, investors should consider creating multiple income streams from diverse sources such as private equity funds, angel groups, and venture capitalists.

Taking advantage of government incentives like tax credits and subsidies can also help buffer downside risks associated with entrepreneurial ventures while providing additional returns on investments in high-growth sectors such as technology or biotechnology. These measures offer not only protection for investors but also support innovation and economic growth throughout the economy at large.

Support For Innovation And Economic Growth

Investing in startups provides a unique opportunity to support economic growth and innovation. Startups are an important part of the economy, introducing new products and services that can help spur job creation and higher wages. Furthermore, startup investing brings with it tremendous potential returns for investors who manage their risk properly.

This type of investment offers the potential for high returns while still allowing investors to retain some control over their money. As access continues to expand, more people than ever before will now have the chance to participate in this exciting form of investing – one that could potentially yield significant gains if done correctly.

Startup investing presents an appealing option for those seeking to diversify their portfolio and reap financial rewards through supporting innovative businesses.

Conclusion

There are many benefits associated with investing in startups that make it a smart investment strategy for anyone looking for higher yields than generally available through other forms of investments. It has the potential to provide high returns and diversification benefits that can be managed with risk management strategies. Furthermore, it supports innovation and economic growth, which is essential for success.

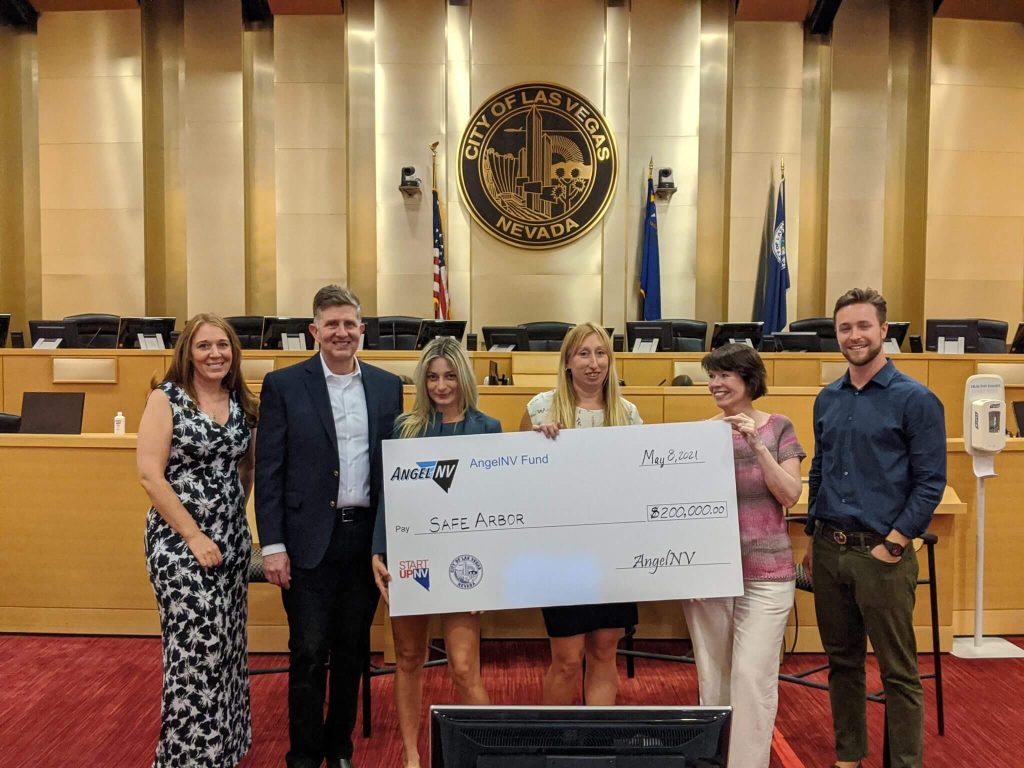

At StartUp NV, our professional mentors educate thousands of people how to become an investor in startups through innovative training, and workshops. Contact us today.

Unlocking The Secrets On How To Become An Investor In Startups Read More »

By:

By: