Investments and New $10M Seed Fund Announced

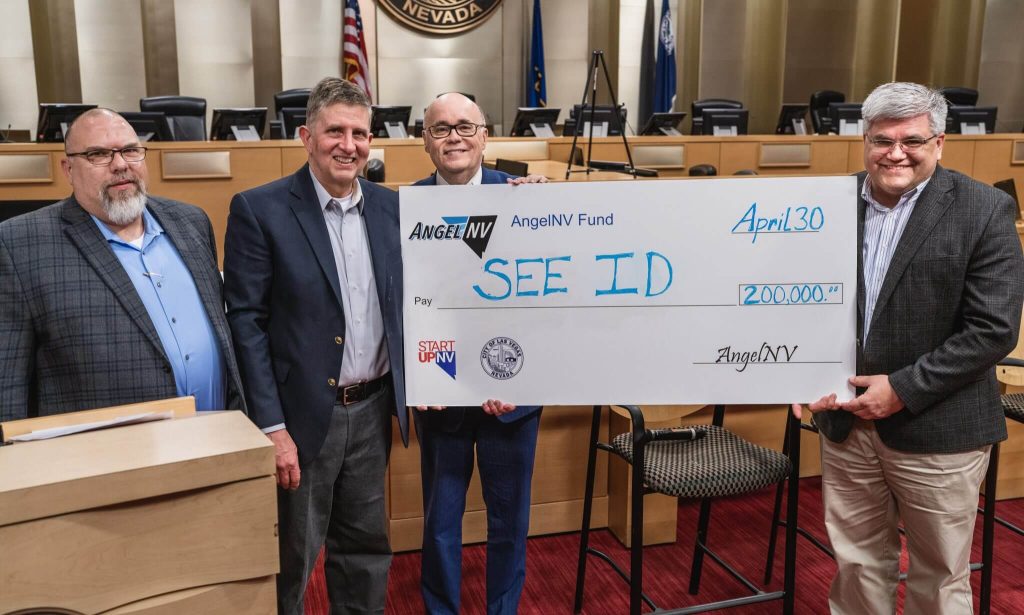

Asset tracking maker, SeeID wins $200,000 investment from AngelNV

New $10 million venture capital fund, SeedNV, announced

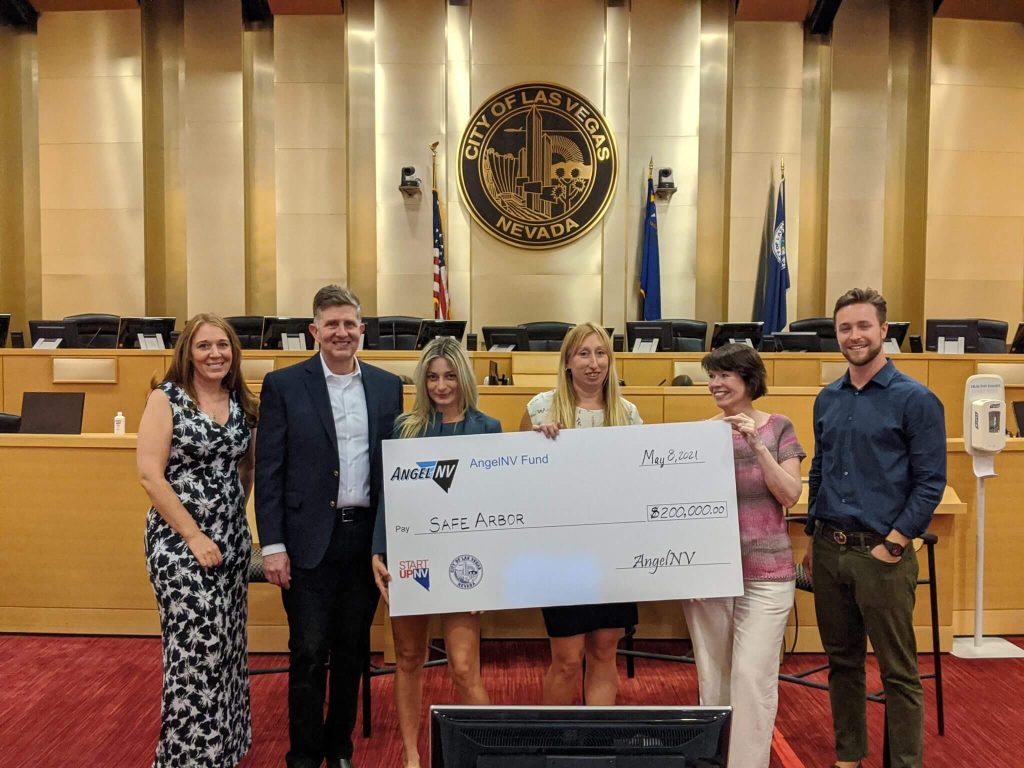

LAS VEGAS – At the annual AngelNV Shark Tank-style grand finale, SeeID, a company that created a real-time asset tracking system, won a $200,000 investment. SemiExact, a furniture kit company, also received an investment of $70,000 as a runner up in the program. Michael Brown, executive director of the Nevada Governor’s Office of Economic Development, attended the event along with other distinguished guests to congratulate the winning companies.

The two companies were selected from more than 250 participants in AngelNV’s free entrepreneur

bootcamp, which educates startup founders how to raise venture capital. The investment funding was

pledged by the more than 50 first-time and experienced investors who participated in the AngelNV

investor bootcamp that teaches angel investing strategies and tactics.

AngelNV is a program of StartUpNV, a nonprofit incubator and accelerator for Nevada-based startup

companies. Since StartUpNV began operation in 2017, more than $75 million has been raised and

invested in 32 companies participating in its programs, including its pre-seed (early stage) venture

capital funds FundNV and AngelNV.

Given the success of these programs and investment funds in supporting startups in Nevada, a later stage

$10 million seed venture capital fund, called SeedNV, has been created and was announced at the

AngelNV event as a new investment option for more mature Nevada-based startups.

Whereas AngelNV invests $50,000 to $200,000 in companies with $0 to $500,000 in annual sales,

SeedNV leads investment rounds of $500,000 to $2 million in companies with $500,000 or more in

annual revenue. SeedNV invests in startups that have previously received investment from StartUpNV

programs and need additional capital as well as new companies with no prior relationship to StartUpNV.

“With the formation of SeedNV, StartUpNV can offer a complete ecosystem of support for the

education, mentorship, and funding of companies from an entrepreneur’s initial idea to A-Round

funding,” said StartUpNV Executive Director Jeff Saling.

Editor’s Note: download photos from the event at

https://www.dropbox.com/sh/ltu56fjk23fybqb/AABO9UFJdwJKl4WeyiZGpiura?dl=0

About StartUpNV

StartUpNV is a non-profit (501c3) statewide business incubator for scalable Nevada startups, providing expert mentorship and access to a network of capital partners for funding through vehicles like FundNV

(www.fundnv.com), AngelNV (www.angelnv.com), the newly established SeedNV (www.seednv.com). Learn

more about StartUpNV at www.startupnv.org.

Investments and New $10M Seed Fund Announced Read More »

Creating Value in Companies Through Communications

By: Andy Abramson

By: Andy Abramson

CEO, Comunicano

Too often, the importance and value of external communications – be it public relations, social media, or event participation – is underestimated by technology-led companies.

While founders often seek attention from the media or relish the opportunity to speak to their audiences, too many companies fail to recognize how vital a well-structured communications program can be to drive and deliver their value proposition, along with its potential to positively impact the company’s valuation. That’s why a Value Creation Communications approach is necessary from a company’s beginning to exit.

Simply put, Value Creation Communications is about engaging with three distinct audiences:

- Customers

- Ecosystem partners

- Investors/Acquirers

These three audiences directly impact a business’s value and, in reality, the founders’ ability to command a higher valuation when acquired. In order to attract these three audiences, the concept of Value Creation Communications (VCC) can be utilized.

For VCC to be successful, the company’s story must be clearly understood. Without a story, a business is just another face in the crowd, but your goal is to be the face the crowd is looking at. That’s why it is essential to tell a story that meets the requirements of the 4 C’s, so that your story is memorable enough to be retold by others the way that you tell it yourself.

The 4 C’s:

- Clear

- Credible

- Compelling

… and…

- CONTAGIOUS

When a story is contagious and begins being retold by others, the business builds its legend. The more your story is told by others, the more prodigious your legend becomes. And with that, the creation of greater awareness of your story.

Creating Value in Companies Through Communications Read More »

Enabling Today’s Era of Prosperous PropTech in the Commercial Real Estate Sector

By: Shreyans Parekh

By: Shreyans Parekh

Director, Corporate Development and Ventures at Fortune 200 Commercial Real Estate Firm

Commercial real estate (CRE) property technology has transformed dramatically over the past decade, especially pushed forward by the COVID-19 pandemic. While this period has proven challenging for the CRE sector, it has also accelerated a number of key PropTech trends that were already beginning to gain traction in the industry. The ability to provide comprehensive platform solutions to commercial real estate owners and operators is at the core of PropTech innovation today.

As a Director of Corporate Development and Ventures at a Fortune 200 CRE firm, I see firsthand that today’s real estate leaders face complex challenges that require the right technologies to solve them. Here are five major CRE PropTech trends that the commercial real estate industry is experiencing in 2022:

- Intelligent facilities management: integrated technology and services deliver a powerful, automated way of managing space today. The era of hybrid work is here, and companies are under pressure to determine how much physical space they need, how to use real estate to attract employees, and how to build healthier, happier and more productive workplaces.

- Modern space management: The hybrid workplace is here to stay, and companies with large, underutilized real estate portfolios are making tough decisions about what to keep, what to shed and how to maximize the potential of every square foot — all while rising to employees’ wants and needs. Strategic planning and space efficiency insights are critical to enhanced space utilization and CRE leaders are re-imagining the commercial office leasing process to an online-first experience for smaller square footage buildings and co-working spaces.

- Smart buildings: occupancy sensors, IoT, air quality, and smart building technologies are permeating the CRE landscape today. AI and machine learning enable IoT sensors and devices to gain insights on how to better manage buildings for both the occupiers and operators. Companies focused on corporate social responsibility and green initiatives.

- Innovative building operations: transforming the way that buildings are managed with tech solutions increases property efficiency and boosts tenant satisfaction. Enhancing the tenant experience through mobile apps provides occupants with building access, accessibility to critical services, and the ability to control their environments.

- Powerful data and insights: cohesive data strategy and systems are now delivering robust insights into the global real estate portfolio. Leveraging insights from public and private data can enable profitable investing by offering valuation tools for commercial buildings and other assets.

According to CREtech, $32 billion was invested in real estate tech companies in 2021, a 28% increase in funding since 2020. Corporate venture funds are also now becoming spun out of commercial real estate firms, as these firms are looking to take a comprehensive and prudent approach to their PropTech investments.

PropTech will continue to improve access to insights for all of these critical use cases as more property managers gain a better understanding of their building operations throughout 2022 and beyond. Transformational technology, data, and analytics will continue to evolve to meet organization’s needs. Cutting-edge real estate technology will help operators and property managers to capture, analyze, and leverage data for more productive, happier, and sustainable workplaces.

Enabling Today’s Era of Prosperous PropTech in the Commercial Real Estate Sector Read More »

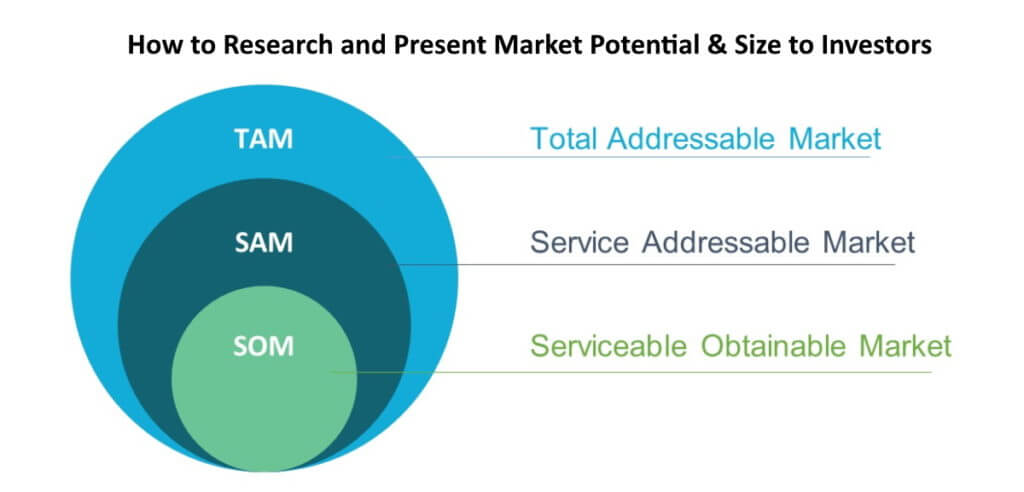

TAM SAM SOM – How to Prepare and Present Market Potential to Investors

StartUpNV teaches you to understand how and what you need to show investors about your market, TAM/SAM/SOM. Utilize additional resources to help round out your market research.

TAM SAM SOM – How to Prepare and Present Market Potential to Investors Read More »

Seraf Compass Deal Terms

The Term Sheet is the document that starts it all. Crafting a term sheet is how most of the real negotiation between investors and company occurs. This book on Term Sheets and Deal Documents will outline key concepts you should master so you will become a better, more informed investor. Or, if you’re an entrepreneur, you can understand what investors are looking for.

Seraf Compass Deal Terms Read More »