Building A Strong Brand Identity: Tips For Early Stage Entrepreneurs

As an early-stage entrepreneur, building a strong brand identity is crucial to the success of your business. Your brand identity sets you apart from competitors and creates a connection with your target audience. It’s more than just a logo or slogan; it’s people’s overall perception of your business.

In this article, we’ll provide tips and strategies for building a strong brand identity that will resonate with your customers and ultimately lead to greater success for your business. So let’s get started!

Define Your Target Audience

If you’re an early-stage entrepreneur, defining your target audience is crucial to create a strong brand identity that resonates with them. Understanding consumer behavior and conducting market research are the key factors in identifying your ideal customer.

By doing so, you can tailor your messaging and branding efforts toward their preferences and needs. To understand consumer behavior, research their demographics, psychographics, and behaviors.

- Demographics include age, gender, income level, education level, location, etc., while psychographics refers to personality traits and values.

- You should also observe their buying habits and preferences to gain insights into what motivates them to purchase.

- Market research involves analyzing data from various sources such as surveys, interviews with potential customers or industry experts, and social media analytics tools like Facebook Insights or Google Analytics.

This information will help you identify trends in the market and determine how best to position your product or service for success. With a clear understanding of your target audience’s needs and preferences, you can develop a unique brand personality that truly resonates with them.

Develop a Unique Brand Personality

By defining your brand personality through understanding consumer behavior and conducting market research, you’ll have the foundation to develop a strong brand that speaks directly to them. To develop a unique brand personality, you must reflect your business values and mission in every aspect of your branding. This means identifying what makes your company stand out and communicating this through your messaging, visuals, and overall tone.

Consistency is key across all marketing efforts – from social media posts to website design – to ensure customers recognize and trust your brand.

Reflect Your Business Values and Mission

Showcasing your business values and mission through your brand identity can help establish a meaningful connection with your audience. When developing messaging and incorporating brand values into visual design, consider the following tips:

- Identify your core values: What does your business stand for? What are its guiding principles? Knowing these will help you create a clear message that resonates with your target audience.

- Be authentic: People can spot insincerity from a mile away, so make sure your brand identity reflects who you are as a company.

- Highlight what sets you apart: What makes your business unique? Whether it’s exceptional customer service or eco-friendly practices, emphasizing what sets you apart can help attract loyal customers.

- Stay consistent: Once you’ve established your brand identity, maintain consistency across all marketing efforts to reinforce the message and build consumer trust.

By reflecting on your values and mission and incorporating them into your branding strategy, you can create an emotional connection with potential customers beyond just selling a product or service.

Consistency Across All Marketing Efforts

Maintaining consistency across all your marketing efforts is crucial in cementing your business’s identity and building trust with potential customers. You can use brand guidelines to ensure that your communication channels, including social media posts, website design, email campaigns, and advertising materials, align with your company’s visual identity.

- Instagram – consistent use of brand colors and logo on all posts.

- Website Design – cohesive layout and typography throughout the site.

- Email Campaigns – use of branded templates for newsletters and promotional emails.

- Advertising Materials – consistent branding elements such as color palette and font usage.

Implementing consistent visual elements across all marketing channels will help create a strong brand identity that customers can easily recognize.

Create a Memorable Brand Name and Logo

When developing your brand, choosing a memorable name and designing a distinctive logo that accurately represents your business is crucial.

Start by brainstorming brand names that reflect the personality and mission of your company. Consider what you want customers to associate with your brand, such as trustworthiness or innovation.

After deciding on a name, create a logo that complements it visually. Look for inspiration in other logos within your industry or from companies you admire. Remember that simplicity is key; an overly complex logo can be difficult to recognize and remember.

- Choose colors and fonts carefully to convey the right tone for your playful or professional brand.

- A memorable name and logo are essential to building a strong brand identity, but they’re just the beginning.

To establish a robust online presence, consider creating a website and social media accounts that showcase your products or services. Share engaging content regularly to keep followers interested and informed about new developments within your company.

Establish a Strong Online Presence

To establish your business online, you must create a website and social media accounts showcasing your products or services. Your website design should be user-friendly, visually appealing, and informative. It should clearly communicate what your business is all about and what sets it apart from the competition.

In addition to having a well-designed website, you must have a strong social media strategy. This involves creating compelling content that resonates with your target audience, engaging with followers through comments and direct messages, and consistently posting updates on new products or services. By doing so, you can build a loyal following of customers who will help spread the word about your brand.

- Establishing a solid online presence requires constantly monitoring and adapting your brand identity. As you gain more insights into what works and what doesn’t work in terms of website design and social media strategy, be willing to make changes as necessary.

- By staying flexible and responsive to feedback from customers and industry experts, you can continue building a brand identity that resonates with people across different platforms and channels while maintaining your core values.

Consistently Monitor and Adapt Your Brand Identity

Now that you’ve established your brand identity, it’s essential to consistently monitor and adapt it to ensure its success.

You should regularly check in with customers for feedback on their experiences with your brand. Additionally, tracking your brand’s performance through various metrics can help you identify areas of improvement or potential issues.

And finally, as market conditions change, feel free to adapt your brand identity to stay relevant and competitive.

Monitor Customer Feedback

Keeping a close eye on customer feedback is crucial for early-stage entrepreneurs to build a strong brand that resonates with their audience. Here are some reasons why monitoring customer feedback is important:

- It helps you understand your customers’ needs and preferences.

- It allows you to identify areas where your brand can improve.

- It provides insights into how the public perceives your brand.

In addition to monitoring feedback, responding promptly and appropriately is just as important. Whether positive or negative, acknowledging and addressing feedback shows that you value your customers’ opinions and care about their experiences with your brand. Doing so shows that you’re listening and demonstrates your commitment to outstanding customer service.

Track Your Brand's Performance

Monitoring your brand’s performance is key to understanding how it resonates with your target audience and making necessary adjustments. One way to do this is by tracking brand analytics, such as website traffic, social media engagement, and sales figures.

By analyzing these metrics regularly, you can identify areas where your brand may be underperforming and make the necessary changes to improve its overall performance. Another important aspect of tracking your brand’s performance is setting clear goals for what you want to achieve.

Whether it’s increasing website traffic or improving customer retention rates, having specific objectives in mind will help guide your efforts and ensure that you’re making progress toward building a strong brand identity. With a clear understanding of your brand’s current standing and where you want it to go, you’ll be better equipped to adapt your brand identity to changing market conditions.

Adapt Your Brand Identity to Changing Market Conditions

Adapting your brand identity to changing market conditions is crucial for staying relevant and competitive, so it’s vital to regularly assess your branding efforts’ effectiveness. This means conducting thorough market research and closely monitoring your competitors’ branding strategies. Doing this lets you identify any shifts in consumer behavior or trends that may require changing your brand messaging or visual elements.

- Market research can help you understand how your target audience perceives your brand and what they value most. This information lets you decide which aspects of your brand identity to emphasize or adjust.

- A competitive analysis allows you to see how other companies are positioning themselves in the market and identify opportunities for differentiation. By staying up-to-date with industry trends and constantly refining your brand identity, you can always meet your customers’ needs and stand out from the competition.

Conclusion

Following these essential tips for building a strong brand identity as an early-stage entrepreneur can help you differentiate yourself from competitors, build brand recognition, and attract your desired customers.

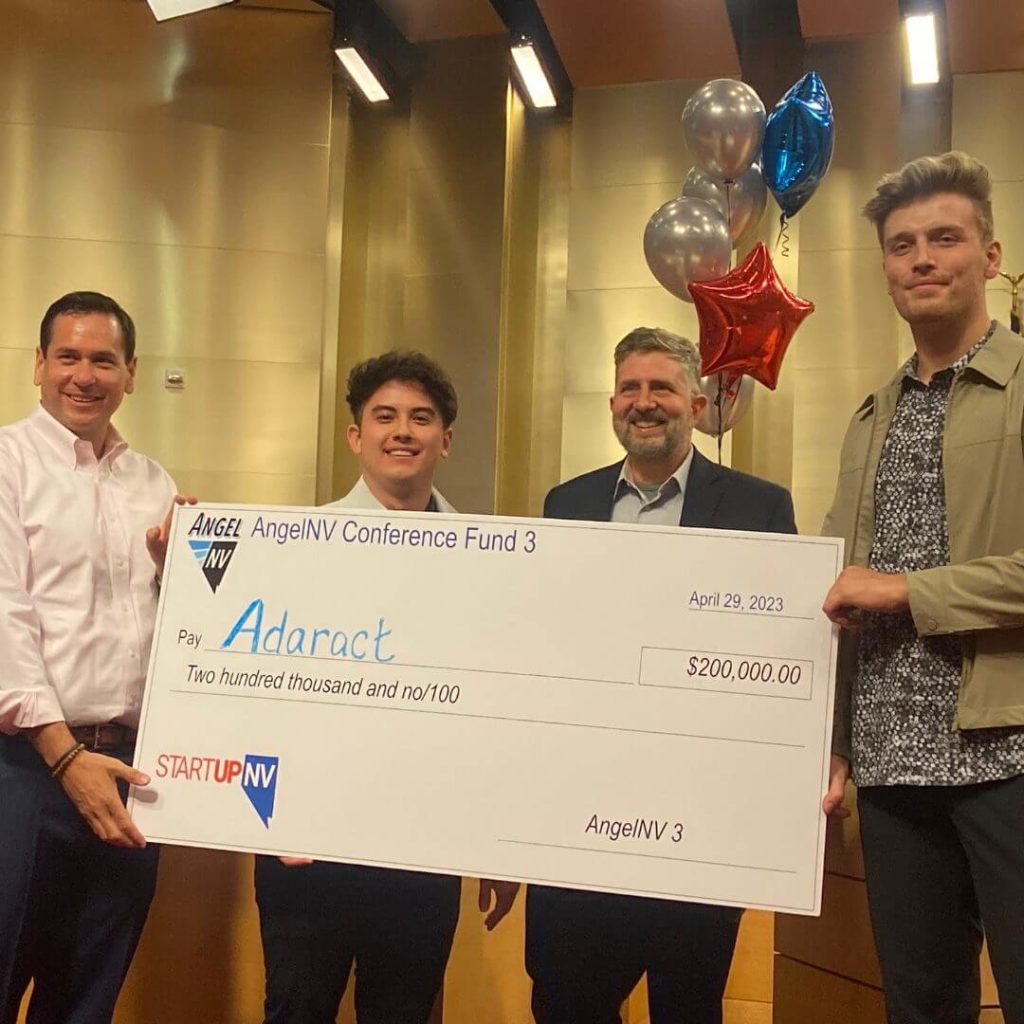

At StartUp NV, we offer young entrepreneurs tailored training, workshops, and invaluable experience from our professional mentors to help them strive in today’s competitive market. Contact us to learn different strategies and techniques that will help boost your startup business.

Building A Strong Brand Identity: Tips For Early Stage Entrepreneurs Read More »