Enabling Today’s Era of Prosperous PropTech in the Commercial Real Estate Sector

By: Shreyans Parekh

By: Shreyans Parekh

Director, Corporate Development and Ventures at Fortune 200 Commercial Real Estate Firm

Commercial real estate (CRE) property technology has transformed dramatically over the past decade, especially pushed forward by the COVID-19 pandemic. While this period has proven challenging for the CRE sector, it has also accelerated a number of key PropTech trends that were already beginning to gain traction in the industry. The ability to provide comprehensive platform solutions to commercial real estate owners and operators is at the core of PropTech innovation today.

As a Director of Corporate Development and Ventures at a Fortune 200 CRE firm, I see firsthand that today’s real estate leaders face complex challenges that require the right technologies to solve them. Here are five major CRE PropTech trends that the commercial real estate industry is experiencing in 2022:

- Intelligent facilities management: integrated technology and services deliver a powerful, automated way of managing space today. The era of hybrid work is here, and companies are under pressure to determine how much physical space they need, how to use real estate to attract employees, and how to build healthier, happier and more productive workplaces.

- Modern space management: The hybrid workplace is here to stay, and companies with large, underutilized real estate portfolios are making tough decisions about what to keep, what to shed and how to maximize the potential of every square foot — all while rising to employees’ wants and needs. Strategic planning and space efficiency insights are critical to enhanced space utilization and CRE leaders are re-imagining the commercial office leasing process to an online-first experience for smaller square footage buildings and co-working spaces.

- Smart buildings: occupancy sensors, IoT, air quality, and smart building technologies are permeating the CRE landscape today. AI and machine learning enable IoT sensors and devices to gain insights on how to better manage buildings for both the occupiers and operators. Companies focused on corporate social responsibility and green initiatives.

- Innovative building operations: transforming the way that buildings are managed with tech solutions increases property efficiency and boosts tenant satisfaction. Enhancing the tenant experience through mobile apps provides occupants with building access, accessibility to critical services, and the ability to control their environments.

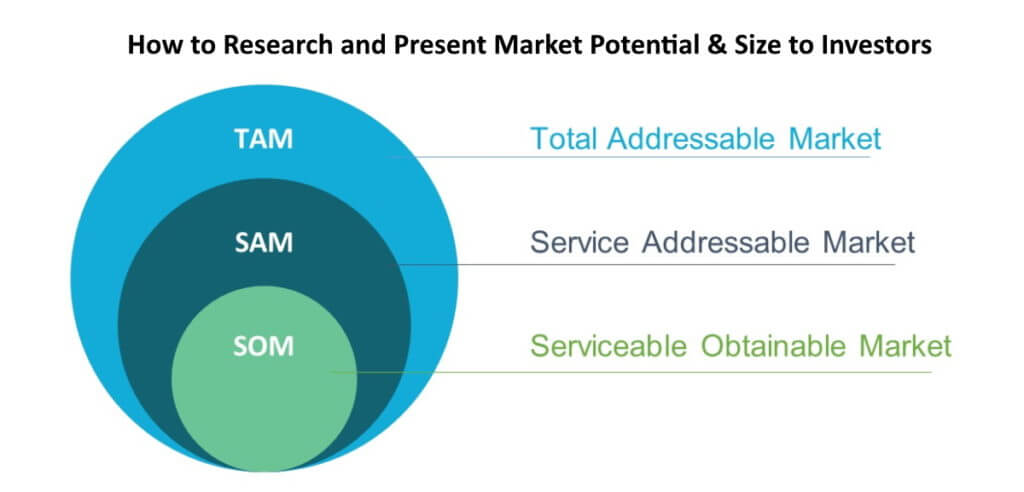

- Powerful data and insights: cohesive data strategy and systems are now delivering robust insights into the global real estate portfolio. Leveraging insights from public and private data can enable profitable investing by offering valuation tools for commercial buildings and other assets.

According to CREtech, $32 billion was invested in real estate tech companies in 2021, a 28% increase in funding since 2020. Corporate venture funds are also now becoming spun out of commercial real estate firms, as these firms are looking to take a comprehensive and prudent approach to their PropTech investments.

PropTech will continue to improve access to insights for all of these critical use cases as more property managers gain a better understanding of their building operations throughout 2022 and beyond. Transformational technology, data, and analytics will continue to evolve to meet organization’s needs. Cutting-edge real estate technology will help operators and property managers to capture, analyze, and leverage data for more productive, happier, and sustainable workplaces.

Enabling Today’s Era of Prosperous PropTech in the Commercial Real Estate Sector Read More »