The Silver State isn’t just an oasis of entertainment; savvy entrepreneurs know that Nevada offers a winning hand for business ventures. From cutting-edge innovations in blockchain and artificial intelligence to traditional industries like mining and agriculture, Nevada is where tech meets tradition in the most unexpected ways. It’s like being on the frontier of discovery—only with air conditioning!

Discover the top 8 reasons why Nevada is the ultimate destination for startups looking to thrive.

Something (or Somewhere) for Everyone

Nevada’s varied landscapes make it an outdoor enthusiast’s paradise and a thriving scene for city dwellers alike. The state offers everything from hiking and skiing in Great Basin National Park and Tahoe to world-class entertainment and dining in Reno and Las Vegas. This blend of natural beauty and urban sophistication caters to all lifestyles and can be a great bonus for businesses looking to entertain or team-build.

Choose Your Climate:

If you love four seasons or winter sports, Northern Nevada has you covered. Need a break from the startup grind? Take the afternoon to ski at one of the many world-class ski resorts, paddle board on Lake Tahoe, or hike up to Angora Lakes for a refreshing jump off the cliffs.

Do you prefer never to touch a snow shovel, and podcast poolside all year long? Southern Nevada boasts over 300 days of sunshine per year. When you need a break from the startup grind, you can take a hike in Red Rock Canyon, catch a show on the Strip, or try your luck at the blackjack table (but not with your investors’ money!).

It’s not just the landscape in Nevada that is diverse, the breadth of industries that thrive in Nevada is almost as wide as the desert stretches.

Growing Economies

Nevada is home to rapidly growing industries, providing ample opportunities for startups to scale. The state’s economy is diversified with key industries including technology, tourism, healthcare, manufacturing and logistics. The presence of major companies and industry leaders in these sectors creates a favorable ecosystem for startups to tap into existing networks and leverage partnerships, plus help to attract more investors and venture capitalists, increasing the availability of funding for startups.

Here are some emerging sectors in Nevada and why they’re attracting startup innovation:

- Renewable Energy:

Nevada’s abundant sunshine and open spaces make it an ideal location for renewable energy innovation, particularly solar power. With ample opportunities for solar farms and rooftop solar installations, startups in the renewable energy sector are capitalizing on the state’s favorable climate conditions and supportive policies to drive innovation in clean energy technologies. Additionally, initiatives like the Renewable Energy Tax Abatement Program incentivize investment in renewable energy projects, further fueling growth in this sector.

One of the most significant contributions of Elon Musk to Nevada is the construction and operation of the Tesla Gigafactory located near Reno. The Gigafactory is a massive lithium-ion battery and electric vehicle (EV) production facility that plays a crucial role in Tesla’s mission to accelerate the world’s transition to sustainable energy.

Portfolio Company Feature: Terbine collects data from Internet of Things devices and packages the data into usable information for planning, including creating digital twins of cities.

- Aerospace and Defense:

Nevada’s vast airspace and proximity to military installations like Nellis Air Force Base and the Nevada Test and Training Range make it a prime location for aerospace and defense startups. With opportunities for research, development, and testing of unmanned aerial vehicles (UAVs), space exploration technologies, and defense systems, startups in this sector benefit from access to specialized facilities and expertise.

Portfolio Company Feature: SEEID

SEE ID is a real-time asset tracking, edge data source and secure access controller company. They leverage the latest technologies including their own patented passive RFID tracking solutions, low-power BLE, GPS, AR/VR, Edge Camera Platforms utilizing AI, and more to build the future of real-time tracking.

- Advanced Manufacturing:

Nevada’s strategic location, transportation infrastructure, and skilled workforce position it as a hub for advanced manufacturing startups. With opportunities in industries such as electronics, aerospace, and biotechnology, startups are leveraging technologies like 3D printing, automation, and robotics to drive innovation and efficiency in manufacturing processes. Moreover, initiatives like the Workforce Innovation for the New Nevada (WINN) Program provide funding and support for advanced manufacturing projects, fostering growth and competitiveness in this sector.

- Healthcare and Biotechnology:

Nevada’s growing population and demand for healthcare services create opportunities for startups in the healthcare and biotechnology sectors. With access to research institutions like the University of Nevada, Las Vegas (UNLV) School of Medicine and the Cleveland Clinic Lou Ruvo Center for Brain Health, startups are developing innovative solutions in areas such as telemedicine, medical devices, and pharmaceuticals. Additionally, initiatives like the University of Nevada Reno’s Nevada Center for Applied Research (NCAR) provide resources and support for healthcare and biotech startups to accelerate their growth and commercialization.

Portfolio Company Features:

Adaract: Adaract introduces a stronger and lighter solution with their artificial muscle actuators.

SurgiStream: Surgistream offers a digitized platform for healthcare professionals to manage patient communication, scheduling, and medical clearance tracking.

- Artificial Intelligence:

Nevada’s AI industry has been gradually expanding, driven by factors such as the increasing adoption of AI technologies across various sectors, including gaming, entertainment, hospitality, healthcare, and autonomous systems. Nevada has been at the forefront of autonomous vehicle testing and deployment, thanks to its supportive regulatory environment and infrastructure. AI startups focusing on autonomous systems, robotics, and drone technology may find Nevada an especially attractive location for development and testing.

These industries represent just a glimpse of the diverse opportunities for startup innovation in Nevada. With its supportive business climate, skilled workforce, and strategic advantages, Nevada continues to attract entrepreneurs and startups looking to turn their innovative ideas into reality.

Portfolio Company Features:

AI.xyz: AI.XYZ is a life management tool providing customized suggestions, ideas and support through a personalized AI.

Lucihub: Lucihub lets brands create affordable, professionally edited videos at speed and scale without a production team

TensorWave: The next wave of AI compute for all your AI workloads powered by AMD’s Instinct™ MI300X accelerators.

Tax Advantages

One of the major advantages of starting a business in Nevada is the favorable tax environment. The state has no personal income tax, no corporate income tax, and no franchise tax. This means that startups can retain more of their hard-earned cash and allocate it toward business growth and development. Additionally, Nevada offers various tax incentives and exemptions for businesses, such as sales tax abatements and property tax abatements, further reducing the tax burden on startups.

It’s like hitting the jackpot without even stepping foot in a casino!

Thriving Business Ecosystem

Nevada offers a business-friendly environment with low taxes and minimal regulatory hurdles, facilitating swift startup launches and expansions.

Extremely Business-Friendly Environment

Nevada’s business-friendly policies, including low taxes and minimal regulatory hurdles, create an attractive environment for startups. With a streamlined process for business registration and licensing, startups can quickly establish a presence in Nevada and focus on driving sales growth without unnecessary bureaucratic delays.

Infrastructure and Connectivity

Nevada’s metro cities boast modern infrastructure and connectivity, including transportation networks, telecommunications infrastructure, and access to high-speed internet. These assets facilitate commerce, logistics, and communication, enabling businesses to operate efficiently and compete on a global scale.

The Boring Company and Hyperloop have the potential to impact transportation infrastructure in Nevada and beyond. While these projects are still in the development and testing phases, they represent Elon Musk’s vision for futuristic transportation systems throughout the state, including underground tunnels and high-speed hyperloop networks.

Economic Diversity and Innovation

The state’s efforts to diversify its economy beyond gaming and hospitality have garnered attention, leading to rankings among the top states for economic diversification and innovation, contributing to stability and resilience even in times of economic uncertainty.

Organizations such as the Nevada Governor’s Office of Economic Development monitor and highlight Nevada’s progress in various fields.

Supportive Government Programs & Legislation

Nevada’s government offers a range of programs and incentives designed to support businesses at every stage of development. From grants and tax credits to workforce training and infrastructure investments, these initiatives provide startups with the resources they need to succeed and thrive.

In 2023, Nevada became the first state to pass two important pieces of legislation for entrepreneurial growth; AB77 & AB75.

AB77, also known as the Right to Start Act, established a dedicated Office of Entrepreneurship within the Governor’s Office of Economic Development (source: https://thenevadaindependent.com/article/new-initiatives-propel-entrepreneurship-in-nevada)

AB75, or the Nevada Certified Investor Act, makes startup investing more accessible to Nevadans by reducing the income levels required to invest in Nevada-based startups. More on this later!

Startup Community

With a strong and growing network of industry professionals, mentors, and resources, startups in Nevada have access to the guidance and support they need to succeed. The availability of co-working spaces, incubators, and accelerators further enhance the opportunities for startups to thrive in Nevada, and many programs for startups, like all of StartupNV’s, are no-cost to founders. In addition to a robust presence in Nevada’s more populated cities, Nevada has increased funding and resources for entrepreneurial organizations, including StartupNV, to provide resources to rural communities.

Curious about Nevada’s startup ecosystem?

- Check out the scene for free at https://nevada.dealroom.co/intro

- See some of the innovation happening in the state by watching StartupNV’s fortnightly pitch days, where Nevada-based companies pitch their startups for acceptance into AccelerateNV and a $100k investment from FundNV. In addition to these past YouTube videos, you can join us live in person or virtually for upcoming pitch days!

- Attend a Startup Week this fall in Reno or Las Vegas and immerse yourself in Nevada’s startup scene

Plus, Nevada’s public sector is notoriously collaborative with in-state innovators. Take the city of Las Vegas, for example, which has two International Innovation Centers, and check out two ongoing partnerships with Nevada-based startups to make the city safer and more innovative.

Databuoy’s SHOTPOINT shot detection technology has been installed in Las Vegas to notify emergency services the minute a gunshot is detected instead of relying on civilians to report it.

Halo Car has partnered with the city of Las Vegas, rolling out its remote-piloted electric car sharing service in 2023.

The presence of research institutions, universities, and industry associations further enhances the supportive infrastructure in Nevada and encourages partnerships and collaborations. Startups can leverage these resources to access cutting-edge research, talent, and industry expertise, driving innovation and growth.

University of Nevada’s Innevation Center in downtown Reno offers a centralized collaboration space with co-working, events, resources, and a makerspace for University and community members to come together.

Originally a collaboration with Caesars Entertainment, University of Nevada Las Vegas’s Black Fire Innovation center located in the Harry Reid Tech Park welcomes University students, alumni, researchers, and entrepreneurial community members for co-working, events, and bootcamps with an emphasis on gaming, hospitality, and entertainment.

Quality of Life

Nevada offers an exceptional quality of life, making it an attractive destination for startups and their employees. The state boasts a diverse range of recreational activities, from outdoor adventures in stunning natural landscapes to world-class entertainment in Las Vegas.

A Lifestyle That’s Anything But Deserted

Who says startups have to sacrifice work-life balance? With stunning natural landscapes just a stone’s throw away, weekend getaways to majestic mountains or tranquil lakes are always on the table. And let’s not forget about the world-class entertainment, dining, and nightlife options that make living in Nevada a constant adventure.

Low Cost of Living That’ll Leave You Feeling Like a High Roller

Compared to coastal counterparts like California and New York, Nevada boasts a significantly lower cost of living, allowing startups to stretch their runway further without sacrificing quality of life. From affordable housing and office space to budget-friendly amenities, entrepreneurs in Nevada can enjoy all the perks of big-city living without the hefty price tag.

Outdoor Recreation

Nevada offers residents and visitors a high quality of life and abundant outdoor recreational opportunities, including national parks, scenic landscapes, and recreational activities such as hiking, skiing, and boating. The state’s natural beauty, mild climate, and access to outdoor amenities consistently earn Nevada top rankings for quality of life and outdoor recreation.

Access to Funding

Startups in Nevada have access to an increasing range of funding options, an often necessary step to grow their businesses. The state offers various grants, loans, microloans, and tax incentives specifically designed to support startups. Additionally, Nevada has a growing network of angel investors and venture capitalists that provide funding opportunities for companies to scale. The presence of investment funds and accelerators is on the rise, further enhancing the access to funding for startups in Nevada.

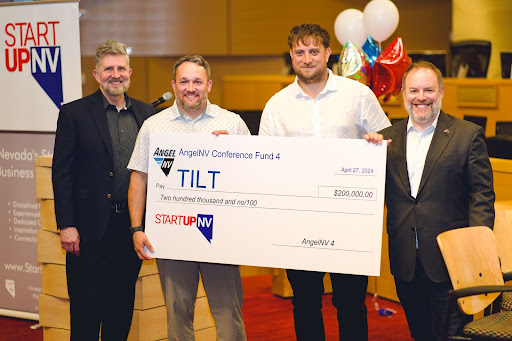

As of April, 2024, StartUpNV has invested $8.6m into 25 Nevada-based companies, which has a current portfolio of more than $24m.

Created during the 2011 session of the Nevada Legislature, the Governor’s Office of Economic Development (GOED) is the result of a collaborative effort between the Nevada Legislature and the Governor’s Office to restructure economic development in the state. In 2021, as part of the American Rescue Plan Act, Biden reauthorized the State Small Business Credit Initiative to create job opportunities and fund entrepreneurship.

Nevada invests this money directly into Nevada-based scalable startups. The state’s SSBCI Battle Born Venture fund, championed and overseen by GOED, is an initiative that invests alongside established venture and accelerator firms, including StartupNV, with a dollar-for-dollar match on approved investments. Learn more about Nevada’s small business capital programs here.

In addition to increasing access to funding, Nevada is also addressing access to investing and reducing barriers, and offering education for individuals to become savvy startup investors.

Access to Investing

As mentioned briefly earlier, legislation AB75 has become the first-in-the-nation state to create access-oriented investor laws beyond the SEC’s definition of an accredited investor. StartUpNV is proud to have been involved in championing this historic bill. As defined by the SEC, an accredited investor must have a net worth of $1m, not including their primary residence, or have made >$200,000 for the past two years and expect to do the same for the upcoming year. About 4% of Nevadans meet the federal standard – compared to 13% nationally and over 16% in California. As a result, it is significantly more difficult for Nevada startups to raise local capital. It’s also significantly less likely for Nevadans to grow personal wealth from startup investments – being “forbidden” to invest in this risky but lucrative investment cohort.

AB75 introduced a new standard for intrastate investing: The Nevada Certified Investor (NCI). NCI allows investment in Nevada startups by Nevadans who earn more than $100K per year in wages. If you own a business or do gig work, the standard is $200K in gross sales. The NCI standard enables about 30% of Nevadans to be eligible as startup investors. At the same time, it greatly expands the group of possible investors for Nevada startups.

Access to Investor Education & Dealflow

StartupNV’s AngelNV program is an annual conference fund that invites new and experienced investors to invest at a low minimum of $5k. Not only is the minimum significantly lower than the majority of angel or venture funds, but the investments strictly go to Nevada-based companies. For many, one of the great values as an investor is (optionally) participating in weekly sessions as an investor group evaluating, doing diligence, and interacting with applicant companies alongside seasoned startup investors and analysts to narrow down the potential investments.

This is a great way to dip your toes into startup investing and learn how to make educated investments, find a new community of like-minded friends, and start building that portfolio! I also recommend (if/when they can afford to) this program as a great low-risk opportunity for startup founders to spend some time on the other side of the table.

StartUpNV facilitates a number of opportunities to engage in startup investing, either as an angel or as part of a venture fund. Investors in any of our initiatives are then added to our InvestorNV syndicate, receiving ongoing deal flow of investment opportunities.

Strategic Location & Access to Talent

Location, Location, Location

Nevada’s strategic location in the western United States offers several benefits for startups. The state provides easy access to major markets and transportation hubs, making it convenient for startups to distribute their products and reach customers across the country. The proximity to major cities like Los Angeles, San Francisco, and Salt Lake City allows startups to tap into the talent pools and resources available in these areas.

Expansion

Additionally, Nevada’s central location in the western region makes it an ideal base for expanding into other states. Nevada’s close proximity to international markets, such as Canada and Mexico, provides additional opportunities for startups to expand their customer base. The state’s robust infrastructure, including transportation networks and logistics facilities, enables startups to distribute their products and reach customers worldwide efficiently.

With a growing population and a steady influx of newcomers attracted by job opportunities and quality of life, Nevada also offers businesses access to a diverse pool of talent.

An Easy Sell

The low cost of living and absence of state income tax makes it easier for startups to attract and retain top talent. Whether in technology, hospitality, healthcare, or other industries, startups can recruit skilled professionals from around the world to fuel their growth and innovation. Feel free to send potential candidates to this blog to aid in your recruiting efforts ;).

Melting Pot of Cultures

Nevada’s rich cultural tapestry is as diverse as it is vibrant. From the Native American tribes who have called the state home for centuries to the influx of immigrants who came seeking their fortunes during the Silver Rush, Nevada is a melting pot of cultures and traditions.

Remote or In-Person Teams

Nevada offers flexibility for startups in terms of team setup. Whether startups prefer remote teams or in-person collaboration, Nevada provides options to accommodate different work styles. The availability of advanced communication technologies and high-speed internet further facilitates remote work and virtual collaboration. Nevada’s airports are easy to fly in and out of, and there is no shortage of accommodations, meeting space, and options for in-person summits, bringing in all your employees from around the world.

Global Sales Funnel

Nevada’s business-friendly environment and strategic location make it an ideal gateway for startups to access global markets. The state’s strong trade relationships and favorable business climate make it easier for startups in Nevada to engage in international trade and establish a global sales funnel.

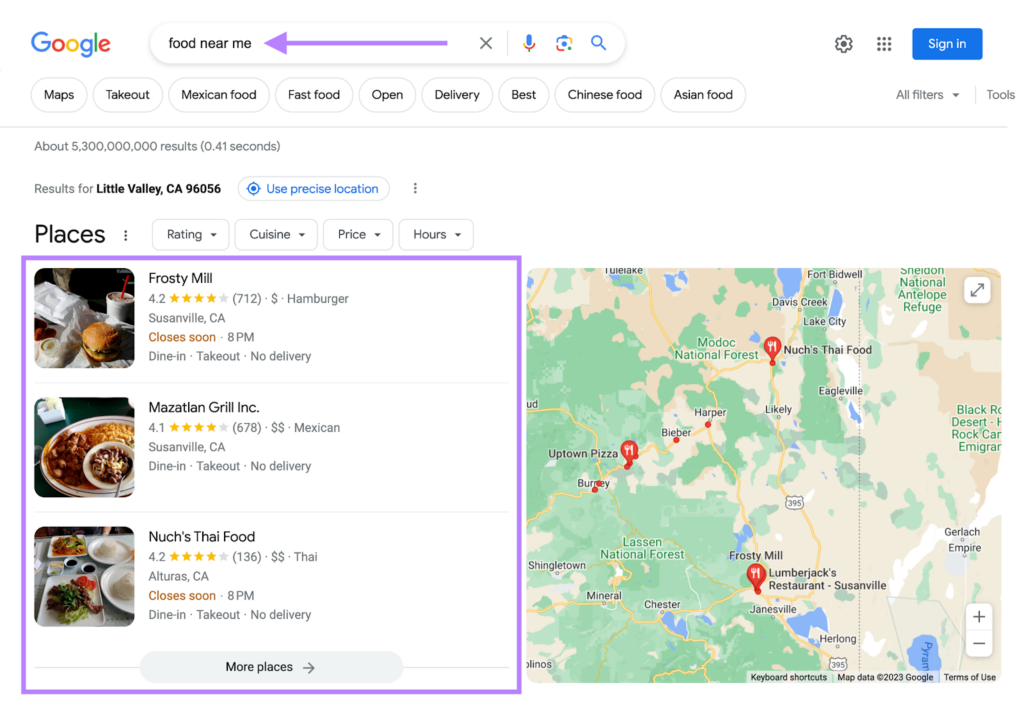

Las Vegas offers several compelling advantages for startups looking to establish sales and business development teams in the city:

Networking Opportunities

Las Vegas hosts numerous industry conferences, trade shows, and networking events throughout the year, providing valuable opportunities for sales and business development professionals to connect with potential clients, partners, and investors. Events like CES (Consumer Electronics Show) and various industry-specific conventions attract a diverse range of attendees from around the world, making it easier to expand professional networks and generate leads.

Entertainment and Lifestyle Amenities

Las Vegas’s renowned entertainment and lifestyle amenities make it an attractive destination for sales and business development employees. With world-class dining, entertainment, and recreational options available year-round, employees can enjoy a high quality of life outside of work, enhancing retention and job satisfaction.

This Blog, Wrapped

Overall, Las Vegas offers startups a strategic location, affordability, a business-friendly environment, networking opportunities, lifestyle amenities, and access to a talented workforce, making it an excellent choice for establishing sales and business development operations.

My personal ask is that if you do settle in the Battle Born state, that you join our startup community! There are several organizations and opportunities to find community throughout the state. If you’ve had success as a startup founder, senior exec, or subject matter expert, please pay it forward by investing your time, knowledge, and/or capital into future generations of innovation. If you’re taking the leap on your first venture, please surround yourself with people who “get it”. Community is important, and while entrepreneurs are known in many ways for their knack for bold independence, I promise we’re all better when we come together.

Let’s face it—Nevada is just plain cool. From its iconic landmarks like the Hoover Dam and Area 51 to its quirky roadside attractions and colorful characters, Nevada is a place where anything is possible. So why choose Nevada for your startup? Because when it comes to chasing your dreams, there’s no better place to roll the dice.

Written by Madeline Feldman, VP of Southern Nevada for StartupNV