Tips for Female Entrepreneurs in a Male Dominated Investor World

By Maggie Saling, Chief of Staff and Communications Director for StartUpNV

Female entrepreneurs should include in their pitch decks for investors the very same information as male founders. The seven main pitch presentation topics to address are: the problem they are solving, the solution, the market opportunity and competition, business model, traction if there are sales, corporate team, and the ask/use of funds. The real difference in the pitch presentation for male and female founders comes in how women answer the questions that investors ask.

The Pitch and Presentation

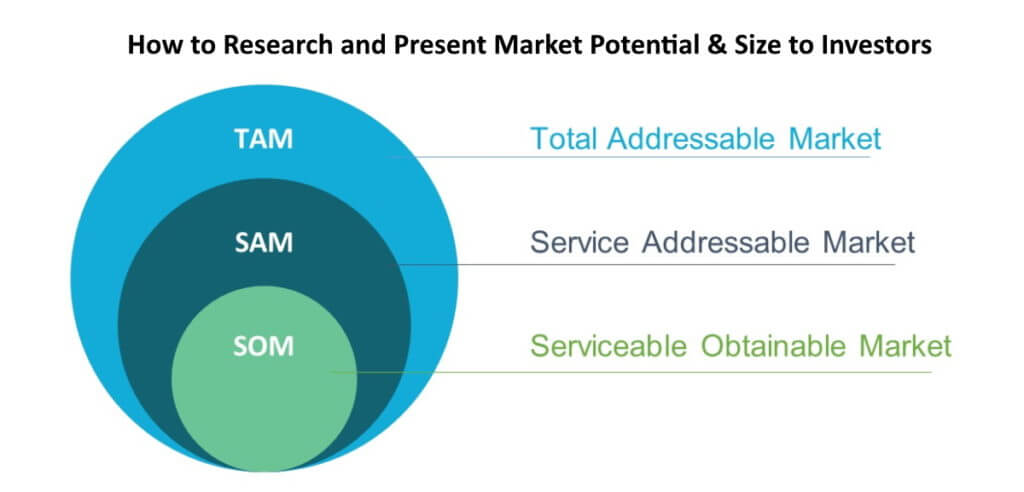

Fitting the presentation into the allotted time is critical. While the 7 topics above should all be covered, the amount of time used on each is variable. For very short presentations (under 3 minutes) creating a hook with a story of how the founder is solving a problem that is real for her and the market size, with one or two sentences on business model should do the trick. When creating a deck, the founder should be striving to impart information and to not have anything in it that makes someone in the audience raise their eyebrows, unless it is the size of the untapped market. Founders need to focus on getting their market size information correct. If a deck includes an arbitrary estimate of getting 5, 10 or even 1% of a large market, investors will know that the founder has not done the research to really understand the market size and how her company fits into the landscape. Being thoughtful about figuring out who their first customers are and estimating their obtainable market based on this shows that the founder really understands the market they’re attacking.

The presentation slides should be engaging and provocative enough that the audience wants to listen to the narration. Wordy slides should be avoided for this reason, and never should a founder read slides to an audience. Videos should not be included because they will fail when you want them to play to the most ideal investor. The Use of Funds slide should be detailed enough that not too many questions need to be asked about it. Founders should practice their pitch so extensively that they can do the narration without glancing backward at the slides if they are projected overhead or behind them.

Preparing for Q&A

In addition, female founders should specifically focus on practicing simulated Q&A. According to an article in Harvard Business Review, venture capitalists, who are typically male, ask different types of questions to male and female entrepreneurs. They tend to ask male founders forward looking and upside type questions (i.e., questions focused on gains, hopes, achievements, advancement, and ideals)and ask female founders more mitigating or negative leaning questions(i.e., those concerned with losses, safety, responsibility, security, and vigilance).As a result, female founders need to learn how to reply to a negatively leaning question by pivoting their answers to provide the upside information.

One technique female founder scan employ in answering prevention oriented questions would be to restate the question in a more positive light and provide the answer accordingly. For example, if asked, “what reserves or processes do you have that will help you survive a market downturn,” the female entrepreneur could reply, “thank you for asking about how I am preparing for all future scenarios to ensure the continued sales and distribution of my product.” In other words, female founders should practice how to turn a negative based question into the question they want to be asked, and then, how to succinctly answer that question.

Answering negative vs. positive questions can have a significant impact on the investment raised. In the Harvard Business Review study, the authors found “that entrepreneurs who fielded mostly prevention questions went on to raise an average of $2.3 million in aggregate funds for their startups…about seven times less than the $16.8 million raised on average by entrepreneurs who were asked mostly promotion questions. In fact, for every additional prevention question asked of an entrepreneur, the startup raised a staggering $3.8 million less, on average.”

Fostering Diversity

Another way to improve the investment Q&A situation for female founders is to attract more female investors who would be more likely to ask the same questions to both genders. Broadening the field of investors also helps to democratize wealth creation in general.

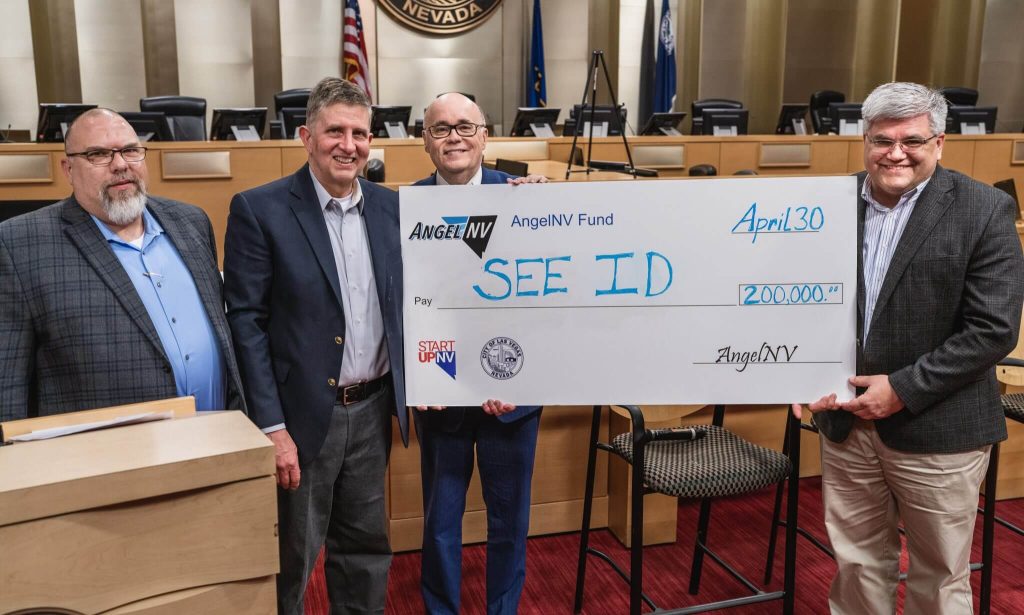

This has been a mission for StartUpNV, a nonprofit incubator and accelerator for Nevada-based startup companies. Its AngelNV program teaches startups how to raise venture capital and advises potential investors on prudent investment strategies. The program’s investors need not be “super wealthy” to participate and can be at the beginning of their investment journey, such as successful professionals or retirees. This enables many people, not just the wealthiest in society, to have the chance to make great returns from a modest $5,000 to $10,000 investment while also helping local startups get off the ground and succeed.

AngelNV has also placed a significant emphasis on recruiting both experienced and first-time investors that are female or from underserved communities to the program that ultimately invests $200,000 or more into Nevada-based startups. Of the 2021 AngelNV investor group,27% were female investors and 52% were minority / underserved community member investors – significantly exceeding national and historic averages.

Programs like AngelNV that seek to democratize wealth creation through private company/startup investment opportunities help build a more resilient economy. And specifically ensuring more women have a voice in the pitch meeting, both as investors and as forward-looking founders, will further diversify our economy and build wealth for women and their families.

About the Author:

As the head of StartUpNV’s Deck Assessment Team, Maggie has seen and reviewed hundreds of pitch decks and presentations. For decades, she has been involved with startups in a variety of industries, including aviation, food, and software, both in support and leadership roles.

Originally posted on Brands Journal

Tips for Female Entrepreneurs in a Male Dominated Investor World Read More »

By:

By: