StartUpNV announces statewide partnerships to expand data collected on Nevada startups by groundbreaking Dealroom platform

StartUpNV announces statewide partnerships to expand data collected on Nevada startups by groundbreaking Dealroom platform

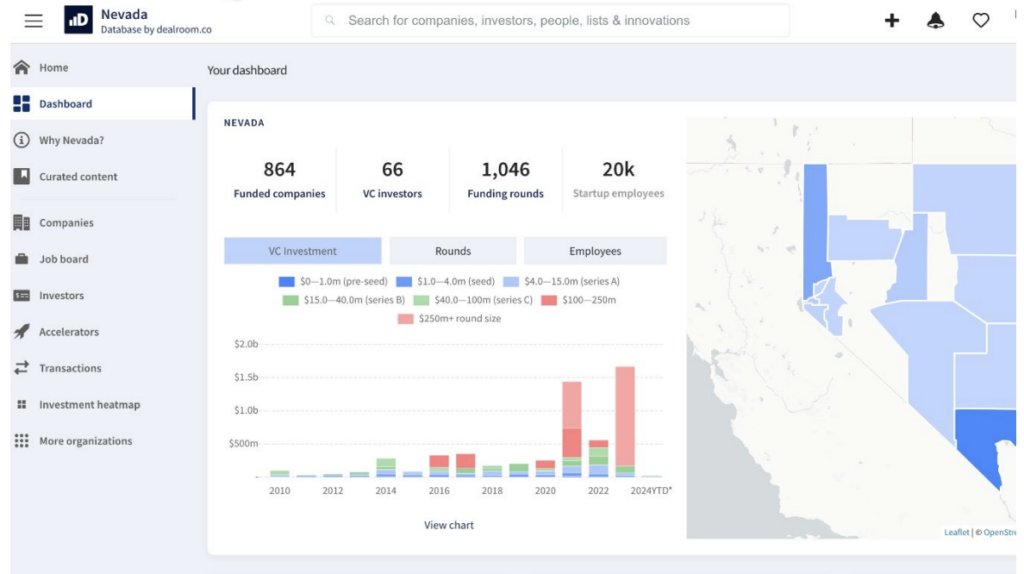

Dealroom shows VC investment in Nevada increasing rapidly, faster than national average

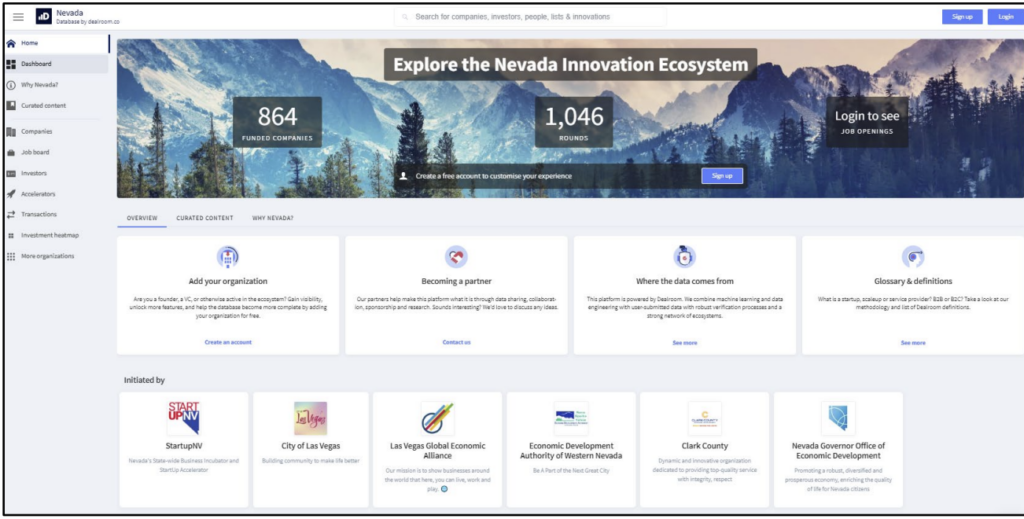

LAS VEGAS, February 26th, 2024 – StartUpNV, a nonprofit statewide incubator and accelerator for Nevada-based startups, announced that the first American startup ecosystem map developed by Dealroom will now track startup activity throughout the state of Nevada.

Originally launched in 2021 as a partnership with the city of Las Vegas, Dealroom and StartUpNV have added the Governor’s Office for Economic Development (GOED), Las Vegas Global Economic Alliance (LVGEA), Clark County Office of Community and Economic Development, and Economic Development Authority of Western Nevada (EDAWN) as partners in the initiative that provides intelligence on startups, innovation, investors, funding rounds and other insights online at https://nevada.dealroom.co/intro.

The Dealroom map is an open-access platform designed to facilitate data-driven policy and decision making through the sharing of cross-industry knowledge. It also fosters the partnerships required to help the next generation of innovators succeed on the global stage.

Of the many insights the platform presents, Dealroom asserts that the top industries receiving venture capital (VC) investment in Nevada since 2019 are transportation, energy, fintech, gaming, marketing, and security (listed in order of the greatest monetary amount).

Additionally, according to Dealroom, VC investment in Nevada increased in 2023, unlike elsewhere, and it has grown 9 times faster since 2019 when compared to the U.S. national index. Capital raised by Nevada-based companies in 2023 included more than $25 million in pre-seed and seed rounds and more than $42 million in Series A rounds. Dealroom also asserts that the valuation of Nevada’s startup ecosystem based on companies with headquarters in Nevada over the last ten years has grown dramatically: $1.9 billion in 2013 to $27.3 billion in 2023.

“StartUpNV focuses on making it easier for entrepreneurs and investors to connect so we can build Nevada’s startup ecosystem that helps diversify our economy,” said Jeff Saling, executive director of StartUpNV. “Dealroom’s open and collaborative platform houses a wide breadth of information of interest to startups, investors, and anyone interested in economic development in Nevada. We encourage founders, investors, accelerators, and funds to check or add their company data on the Dealroom platform. This collaborative effort to provide open access to relevant business insights will help ensure we maximize the great value of this tool to track the success of Nevada’s startup ecosystem.”

“Dealroom was founded around a central mission to make discovery of promising companies easier for everyone, wherever they are in the world,” said Yoram Wijngaarde, Dealroom CEO. “The new Nevada startup database is about just that, chronicling the most exciting companies based across the Silver State, such as those innovating in EV batteries, cloud computing, nanotech, and more. We believe this platform will act as a practical GPS for innovation ecosystem decision-makers to navigate the state’s burgeoning startup landscape, as well as encourage users to become part of a community in which data is shared for the good of everyone. We’re so excited for Nevada to join over 100 startups and innovation ecosystems worldwide powered by Dealroom, and to partner with StartUpNV and the Nevada Governor’s Office for Economic Development on this important project.”

“We want to make Nevada as welcoming as possible to entrepreneurs and early-stage high growth companies while helping local startups connect with investors and other entrepreneurs,” said Karsten Heise, Senior Director of Strategic Programs and Innovation at GOED. “GOED’s innovation based economic development approach supporting startups and founders needed a statewide coverage under this initiative. We saw how successful this was in Las Vegas, so the expansion presented a great opportunity to make this data readily available and transparent to every ecosystem and its members within our state. The sharing of statistics and demographics via Dealroom’s platform will help to lower barriers to critical information and spur investment and new economic opportunities across Nevada.”

About Dealroom

Dealroom.co is the foremost data provider on startups, growth companies and tech ecosystems globally. Founded in Amsterdam in 2013, Dealroom.co now works with many of the world’s most prominent investors, entrepreneurs and government organizations to provide transparency, analysis and insights on startups and venture capital activity. Startups and organizations in Nevada are encouraged to review their profiles on the platform and ensure current and comprehensive data is reflected. Logos and marketing assets available at https://dealroom.co/press

About StartUpNV

StartUpNV is a 501(c)3 non-profit statewide accelerator and business incubator for scalable Nevada-based startups that provides expert mentorship and access to a network of capital partners. StartUpNV’s founders, mentors, university connections, investors, and business partners work together to grow and support a robust, inclusive startup ecosystem in Nevada. StartUpNV’s related venture funds, FundNV, AngelNV, and the new 1864 seed fund, provide startups access to local venture capital along with education for entrepreneurs and angel investors. Since inception in 2017, StartUpNV has heard pitches from more than 1,000 startups, held more than 250 education events, and seen nearly $80 million in venture capital raised for more than 55 companies. For information visit:

https://startupnv.org/.

MEDIA CONTACTS: Amy Maier, The Warren Group, amy@twgpr.com, 702-904-0296