Understanding Non Dilutive Funding

In the dynamic landscape of startup entrepreneurship, securing adequate funding stands as a pivotal challenge for founders aspiring to transform innovative ideas into thriving businesses. While traditional funding routes often involve relinquishing equity in exchange for financial support, a rising trend is reshaping the narrative—non-dilutive funding. This alternative approach to financing has gained momentum, offering startup founders a viable means to propel their ventures forward without sacrificing ownership stakes.

In this article, we delve into the world of non-dilutive funding, exploring its various forms and unveiling the strategic advantages it offers to startup founders. As the entrepreneurial landscape continues to evolve, understanding and harnessing the power of non-dilutive funding emerges as a crucial skill for those seeking to navigate the challenging yet rewarding journey of startup growth.

What is Non Dilutive Funding?

Non-dilutive funding, in essence, refers to financial resources that entrepreneurs can acquire without yielding equity. Unlike traditional venture capital or angel investments, which demand a share of ownership, non-dilutive funding methods allow founders to raise capital while retaining full control over their companies. This paradigm shift has become increasingly attractive to entrepreneurs navigating the complexities of startup development.

One of the primary reasons non-dilutive funding is gaining popularity lies in its ability to mitigate the dilution of founder equity. In conventional funding scenarios, each round of investment often results in a reduction of the founder’s ownership stake, potentially leading to a loss of control and decision-making power. Non-dilutive funding models, however, circumvent this challenge, empowering founders to maintain a greater share of their companies as they secure the financial backing necessary for growth.

Dilutive vs. Non Dilutive Funding: What’s the Difference?

Distinguishing between dilutive and non-dilutive funding is imperative for entrepreneurs navigating the intricate web of startup finance. At its core, the key distinction lies in the impact on ownership stakes. Dilutive funding, commonly associated with venture capital and equity investments, entails the exchange of a portion of the company’s ownership for financial backing. With each funding round, founders often find themselves relinquishing a percentage of their equity, a necessary trade-off for the capital infusion that propels their ventures forward. On the other hand, non-dilutive funding methods, such as grants, awards, and government incentives, allow founders to secure financial support without parting ways with ownership stakes. This fundamental difference not only shapes the financial structure of a startup but also influences decision-making autonomy and long-term strategic planning.

The contrasting dynamics of dilutive and non-dilutive funding extend beyond ownership considerations. Dilutive funding relies on the valuation and perceived potential of a startup, often tying financial support to the company’s equity worth. In contrast, non-dilutive funding is typically performance-based, with entrepreneurs showcasing their capabilities, innovations, or projects to secure grants or awards. This contrast underscores the diverse paths available to founders, each presenting distinct advantages and challenges. While dilutive funding can inject substantial capital into a startup, non-dilutive funding offers financial resilience and strategic flexibility, creating a nuanced landscape that demands careful consideration and a tailored approach to fundraising.

The Benefits of Non Dilutive Funding for Startup Founders

The advantages of non-dilutive funding for startup founders extend far beyond the preservation of ownership stakes. One of the primary benefits lies in the strategic freedom it affords entrepreneurs. Unlike dilutive funding, which often comes with investor expectations and demands, non-dilutive funding allows founders to chart their own course, making critical decisions without external pressures. This independence proves invaluable as startups navigate the unpredictable terrain of market dynamics, enabling them to remain agile and responsive to evolving challenges.

The main benefits of non-dilutive funding include:

- Preservation of Equity: Founders can secure financial support without sacrificing ownership stakes, maintaining control over their companies.

- Stability in Valuation: Non-dilutive funding mitigates the impact of market fluctuations, providing stability in funding without being tethered to valuation-driven dynamics.

- Innovation without Constraint: Entrepreneurs can pursue ambitious projects and innovations with the support of grants and awards, fostering creativity without the limitations associated with equity-based funding.

- Risk Mitigation: Non-dilutive funding acts as a buffer against economic uncertainties, offering startups a secure financial foundation that isn’t contingent on external market conditions.

- Diverse Funding Sources: Founders can tap into a variety of non-dilutive funding sources, including government grants, industry competitions, and research incentives, creating a mosaic of financial support tailored to their specific needs.

Different Types of Non Dilutive Financing

The realm of non-dilutive financing is diverse, offering entrepreneurs a myriad of avenues to secure capital without sacrificing equity. One prevalent form of non-dilutive financing is government grants. These grants, often provided by governmental bodies to stimulate economic growth and innovation, serve as a critical source of funding for startups engaged in research, development, and technology-driven endeavors. Additionally, corporate-sponsored competitions and incubators represent another facet of non-dilutive financing, wherein companies provide financial support, mentorship, and resources to promising startups without demanding equity in return. This symbiotic relationship fosters innovation within specific industries while affording startups the capital needed to propel their projects forward.

Different Types of Non-Dilutive Financing include:

- Government Grants: Financial support provided by government agencies to encourage research, development, and innovation.

- Corporate Competitions: Startups can participate in competitions sponsored by corporations, receiving funding and support without relinquishing equity.

- Research and Development Incentives: Governments may offer tax credits or incentives to encourage businesses to invest in research and development activities.

- Foundations and Nonprofit Organizations: Entities dedicated to supporting specific causes or industries often provide non-dilutive funding to startups aligned with their mission.

- Strategic Partnerships: Collaborative agreements with established companies can bring non-dilutive funding, resources, and market access.

- Crowdfunding: Platforms allow startups to raise funds from a large number of individuals, often in exchange for early access or perks, without giving up equity.

- Innovation Grants: Specific grants aimed at fostering groundbreaking ideas and technologies, providing financial support to startups with innovative projects.

What is Venture Debt?

Venture debt represents a distinctive financing option that has gained prominence within the entrepreneurial landscape. Unlike traditional loans, venture debt is tailored specifically for startups and high-growth companies that may not yet be profitable but require additional capital to fuel their expansion. This form of debt typically appeals to companies that have secured significant equity financing, allowing them to complement their funding structure with debt to further bolster their operations. Venture debt can take various forms, including term loans, lines of credit, or convertible debt, and is characterized by its flexibility and adaptability to the unique needs of rapidly scaling businesses.

Companies often turn to venture debt for several compelling reasons. Firstly, it serves as a non-dilutive funding source, enabling startups to secure capital without relinquishing additional equity. This is particularly advantageous for founders who wish to maintain control over their companies and preserve ownership stakes. Secondly, venture debt can be deployed strategically to extend the runway between equity funding rounds, providing a financial cushion during critical phases of growth. It proves instrumental in bridging the gap between major funding events, ensuring that companies have the resources required to reach key milestones without undergoing frequent equity dilution. Lastly, venture debt is structured to align with the growth trajectory of startups, featuring flexible repayment terms and often incorporating warrants or equity kickers, allowing lenders to share in the success of the borrowing company.

What is Crowdfunding?

Crowdfunding has emerged as a dynamic and accessible alternative for entrepreneurs seeking to raise capital by tapping into the collective support of a broad audience. At its core, crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. This democratized approach to fundraising allows entrepreneurs to showcase their projects, products, or ideas to a diverse audience and secure financial backing in exchange for various incentives or rewards. Common forms of crowdfunding include reward-based crowdfunding, where backers receive pre-determined perks or products, and equity crowdfunding, wherein contributors become investors and receive a share of the company’s ownership.

Startups may choose crowdfunding for several reasons, each aligned with the unique benefits this method offers. Firstly, crowdfunding enables founders to validate their ideas and gauge market interest before fully launching a product or service. The process of engaging with backers not only provides critical early-stage capital but also serves as a form of market validation, helping founders refine their offerings based on real-time feedback. Additionally, crowdfunding allows entrepreneurs to maintain control over their companies, as the capital raised is not in exchange for equity. This can be particularly appealing for founders who wish to preserve decision-making autonomy and ownership stakes.

For founders considering crowdfunding, several platforms offer diverse opportunities for fundraising. Kickstarter and Indiegogo are popular for reward-based crowdfunding, providing a platform for creators to showcase their projects to a global audience. Equity crowdfunding platforms like SeedInvest and Crowdcube, on the other hand, cater to startups seeking investment in exchange for equity. The choice of platform often depends on the nature of the business, the funding goal, and the type of engagement founders are seeking from their backers.

What is Grant Funding?

Grant funding serves as a vital pillar of financial support for startups and innovative projects, offering non-dilutive capital in various sectors. Common examples of grant funding include government grants, research and development grants, and industry-specific grants. Government grants, provided by federal, state, or local agencies, aim to stimulate economic growth, foster innovation, and address societal challenges. Research and development grants are often awarded to businesses engaged in pioneering projects, promoting advancements in technology, science, and healthcare. Industry-specific grants cater to businesses within particular sectors, encouraging growth and innovation within those domains.

Entrepreneurs seeking grant funding can explore a variety of avenues. Government programs like the Small Business Innovation Research (SBIR) program, operated by the U.S. government, specifically target small businesses and startups engaged in cutting-edge research and development. The Department of Defense (DOD) also offers substantial grant opportunities for projects aligned with defense-related innovations. Additionally, private foundations, non-profit organizations, and corporate entities frequently provide grants to support initiatives that align with their mission or industry focus. The appeal of grant funding lies in its non-dilutive nature, providing startups with financial backing without sacrificing equity. Furthermore, grants often come with the added benefit of validation, as the competitive application process signifies recognition of the project’s potential impact.

For founders, considering grant funding through programs like SBIR or the DOD can be particularly advantageous. The SBIR program, administered by various federal agencies, allocates a portion of their research and development budgets to small businesses. This initiative encourages technological innovation, fosters economic growth, and enables startups to contribute to federal research and development efforts. Similarly, the DOD offers grant opportunities for projects aligned with defense-related innovations, providing startups with a pathway to collaborate with one of the largest and most influential government agencies while securing vital non-dilutive funding.

Is Non Dilutive Funding Right For Your Company?

Determining whether non-dilutive funding is the right fit for your company involves a nuanced evaluation of your startup’s specific needs, growth trajectory, and long-term strategic goals. Non-dilutive funding offers undeniable advantages, foremost among them being the preservation of founder equity. For entrepreneurs who prioritize maintaining control and decision-making autonomy, especially those with a strong belief in the long-term potential of their ventures, non-dilutive funding provides an attractive alternative. This approach allows founders to avoid the potential downsides of equity dilution, such as a loss of control or having to align with investor expectations that may not align with the company’s vision.

On the flip side, dilutive funding brings its own set of advantages that may align with certain companies’ aspirations. The injection of substantial capital through equity financing can rapidly accelerate growth, providing startups with the financial muscle to scale operations, enter new markets, and outpace competitors. Dilutive funding often comes with the added benefit of strategic guidance and industry expertise from investors who have a vested interest in the company’s success. For founders seeking not just capital but also mentorship, networks, and a collaborative partnership, dilutive funding may be the more suitable choice. It’s crucial for entrepreneurs to weigh these factors carefully, considering the immediate and long-term needs of their startups before deciding on the funding approach that aligns best with their vision and growth objectives.

Looking for Equity Financing?

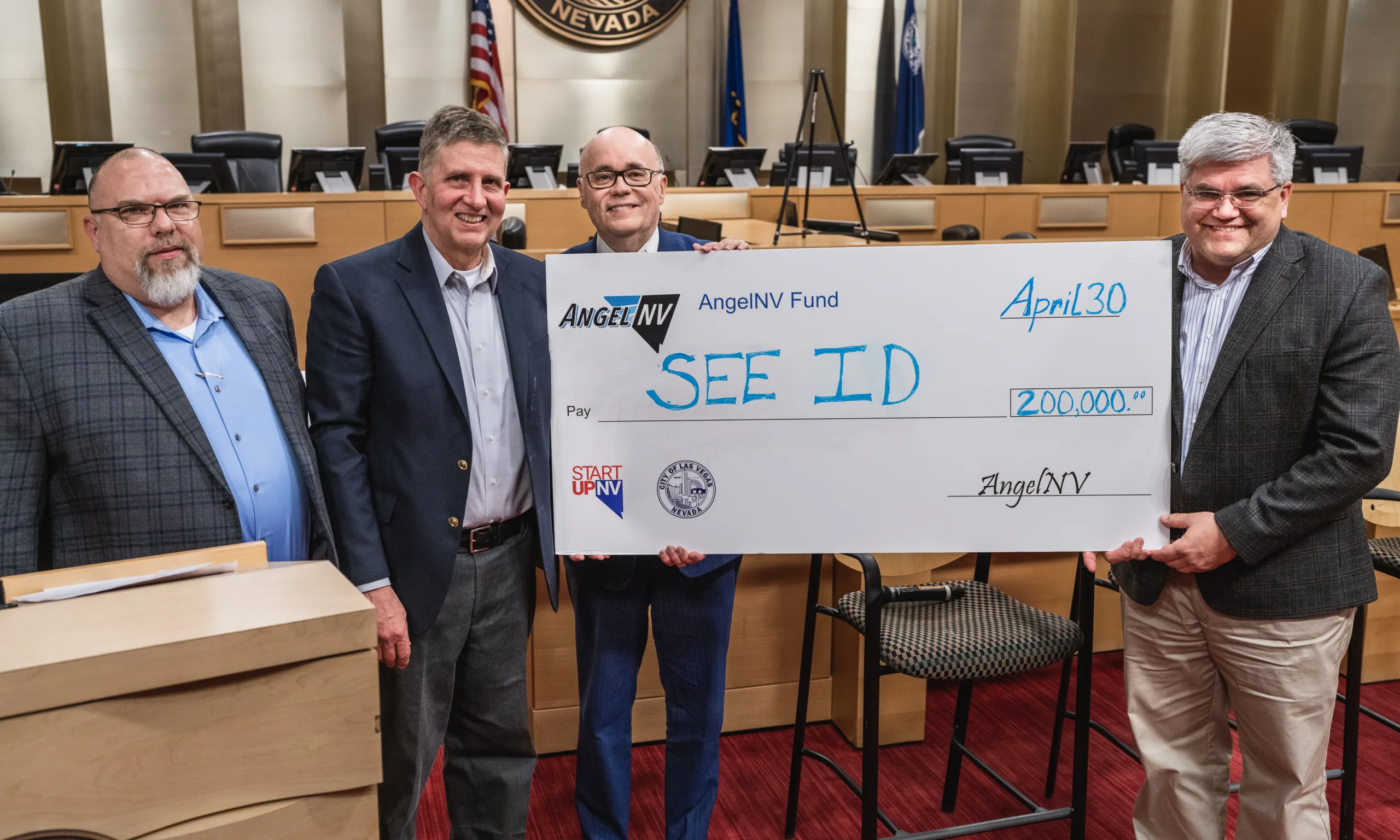

Equity financing remains a cornerstone for startups seeking substantial capital injections while offering investors a stake in the company’s ownership. In the realm of equity financing opportunities, platforms like StartupNV play a pivotal role in connecting entrepreneurs with potential investors and fostering a thriving ecosystem. StartupNV’s programs, for instance, provide a bridge between innovative startups and investors, offering mentorship, resources, and networking opportunities to catalyze growth. These programs often include pitch sessions, where entrepreneurs can showcase their ventures to a panel of investors, and accelerator programs designed to nurture and elevate startups to the next level. By actively participating in equity-focused initiatives like those facilitated by StartupNV, founders gain access to a network of potential investors, strategic partnerships, and the financial backing necessary to propel their ventures toward success.