How Startups Can Adapt to Market Changes

How Startups Can Adapt to Market Changes

A founder can’t always control how the market will act when the business is launched. However, learning how to adapt to the market so that your business strategy is flexible, viable, and attractive to future investors can determine if you can weather the storm or fall victim to the five-year timeline that often claims as many as 65% of new businesses.

Don’t Fear the Pivot

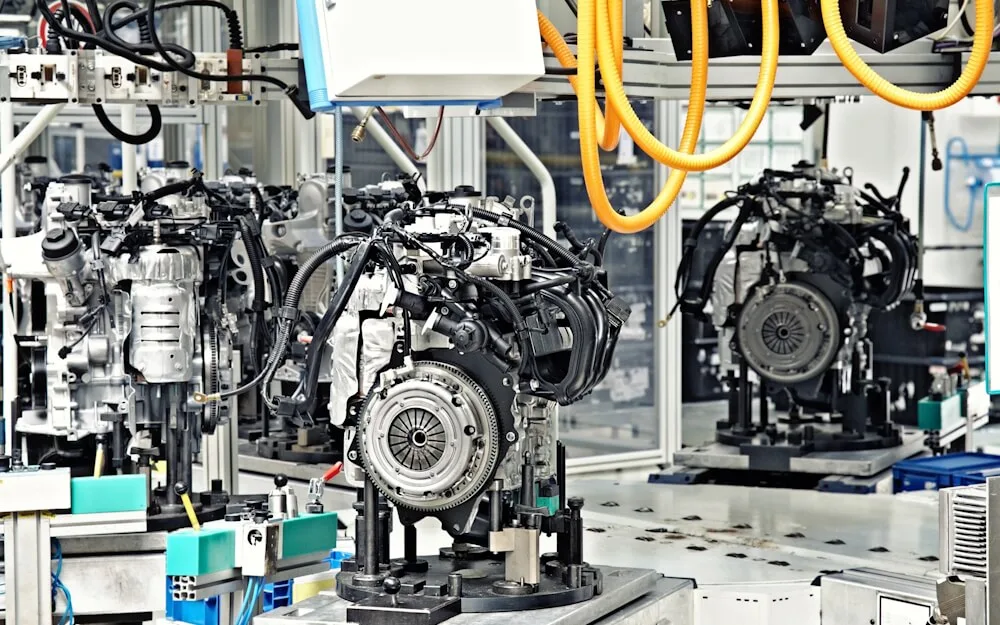

Adaptability is what allows some businesses to thrive even in down markets. Consider that even major corporations often have to change their strategies to survive as technology makes previous products obsolete or market demands require them to refocus their efforts in new directions. A great example of this is Ford Motor Company. Ford initially burst on the scene as an innovator with founder Henry Ford credited for creating automated assembly lines for the iconic Model T.

But a bloated product portfolio in the 2010s meant that the company was wasting resources building cars that weren’t selling enough inventory to justify the expense. Specifically, consumer demand in the United States had long since shifted to SUVs, but the company still had a large sedan segment. In 2018, the firm announced that it would sunset sedans in the U.S., and instead focus exclusively on SUVs and trucks — but retain sedans and crossovers for international markets where the demand is still strong. Eliminating sedans allowed Ford to boost domestic profits and focus efforts on new innovations like electric and hybrid SUVs and trucks.

Listen to Your Target Audience

The U.S. is a country that relies on a supply and demand economy. So, if you’re not listening to what the consumers are demanding, you can’t supply them with a relevant product. For startups trying to navigate shifting markets, this means they can’t risk creating new products or services in a silo or echo chamber.

You might think you have the best new idea, but until you actually test it in front of real customers, you’ll never know whether you have the next startup unicorn — or a dud. To avoid devoting budgets to an untested concept, embrace soft launches, and market testing as part of the design and improvement process. Really listen to what the customer is saying. Early adopters are often willing to be beta testers and act as if they are on your team to enhance the product. Use their input to tweak your strategy or product so that you’re creating a product that genuinely delights your target customer.

Adjust Your Value Proposition

The value proposition is the “why” of a startup’s product or service offering. It explains why a consumer should invest their hard earned money in your offerings as opposed to your competition. An effective value proposition should use the customer’s words to describe the problem and then state how you solve it. It can include intrinsic factors such as your pricing ways that the product is better than the competition and the product or service is delivered.

Tweak Your Go-To-Market Startup Pricing Strategy

This is a critical adjustment factor that many businesses — young and old — must tinker with if long term success is the goal. And this is especially true for startups selling physical or virtual products. Often getting onto shelves in brick-and-mortar businesses can be difficult, so opting for a direct-to-consumer (D2C) business model can help a startup temporarily bypass barriers to entering into traditional consumer markets. First pricing can be used to incentivize buyers but the right price after a following is developed, must be explored. A researched price for the scaling market should be tested against a higher price until the price level where the customer complains but pays it anyway. At that point, true value has been established and will enable the startup to grow towards profitability.

And Don’t Forget the Investors

By far, appealing to your target audience should be your biggest priority. But the same criteria that helps you appeal to consumers is also what investors will use to judge your startup’s viability. Your business needs to not just be interesting, but satisfy an unmet need in the market, build a value proposition that makes it unique against the competition, and with a marketing and sales strategy designed to help you turn a profit.

Knowing how to do this independently can be hard — especially if this is your first time launching a startup. Partnering with StartUpNV by enrolling in one of our seven accelerator and incubator growth programs can help position your startup for success, as well as give you access to mentors and venture capital in Nevada through our extensive investor network.

How Startups Can Adapt to Market Changes Read More »