AngelNV | Investor Education

AngelNV 6 is just around the corner!

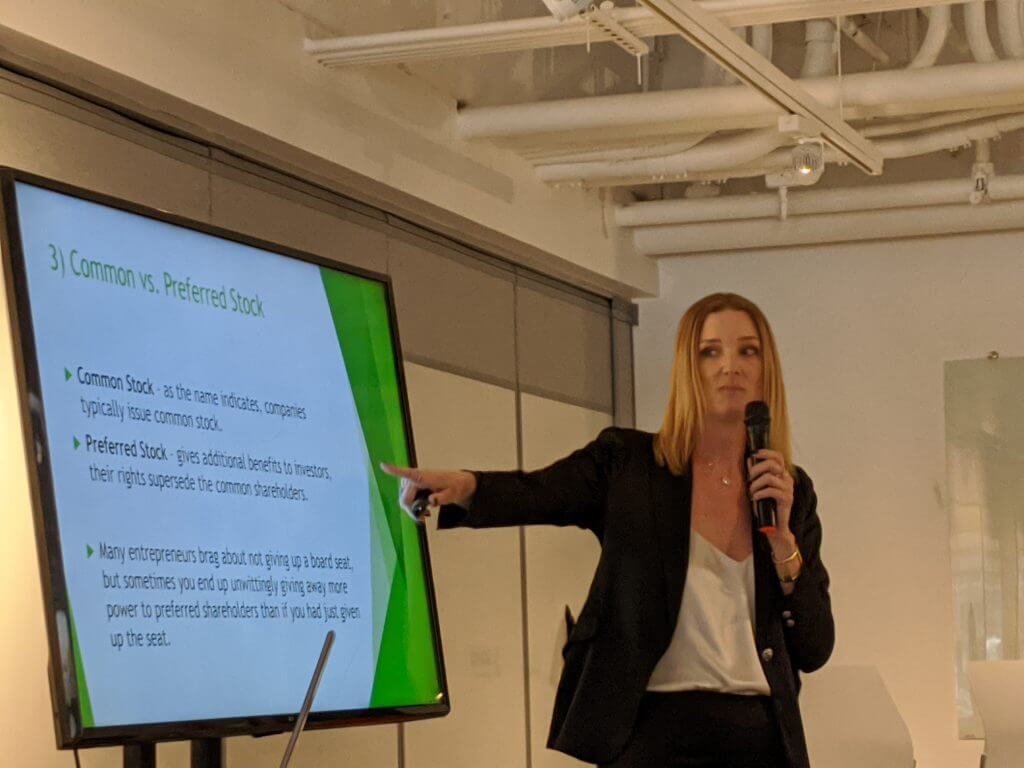

Join your fellow Nevadans as we learn how to invest in startups through this hands on investment session. Starting January 10th, with a half day of investment education, we’ll continue for 12 weeks to whittle down the Nevada startups who have applied for the investment to 6 finalists, get to the hard work of due diligence and make our final selections on April 11, 2026.

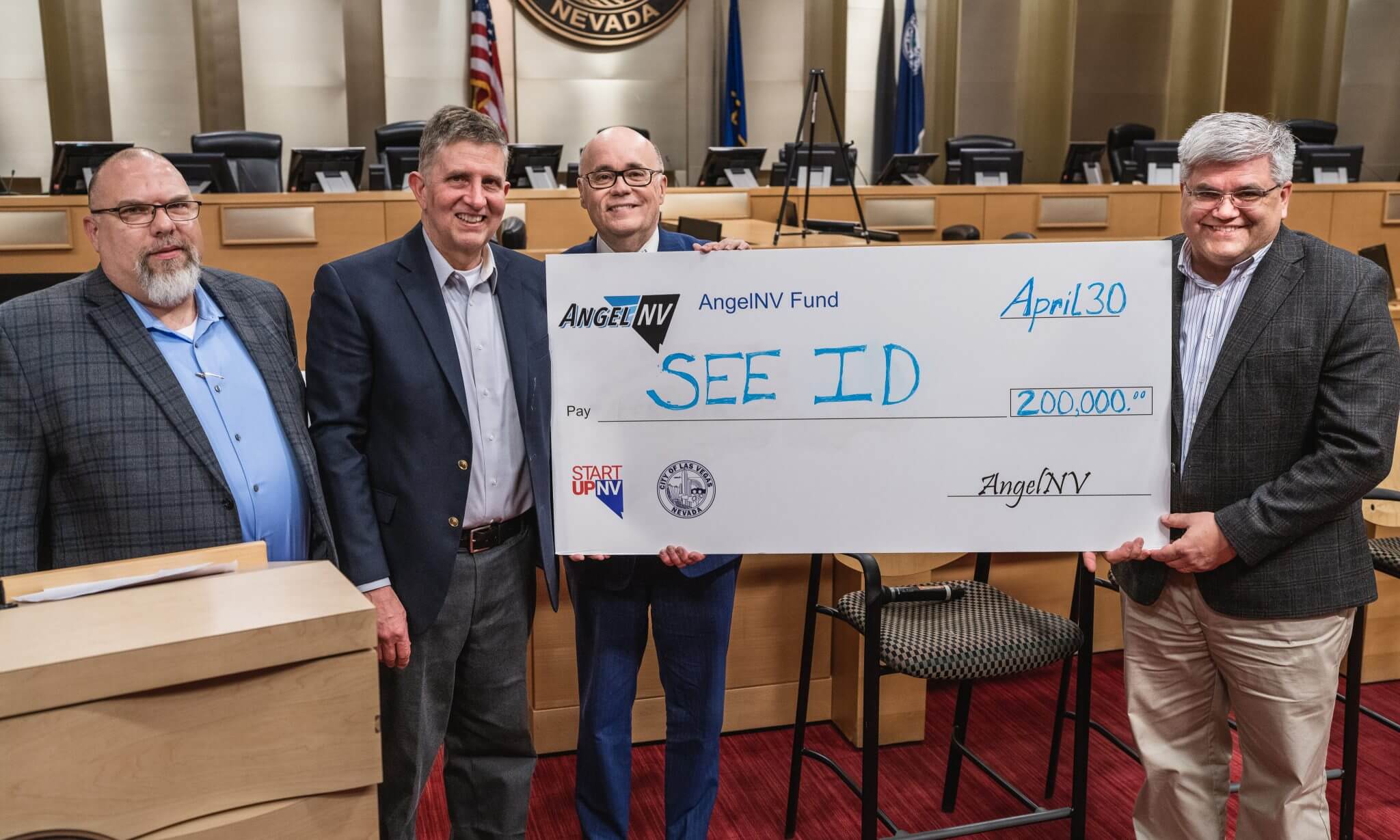

The first place investment of $300k for AngelNV 5, which SSBCI matched, went to BuildQ, a platform for managing large infrastructure projects, especially in the green energy field.

Further investments of $55K each were made in Otsy, LuciHub and KnowRisk(now Voltaire).

– Angels say, “there aren’t any investable deals”.

– Entrepreneurs say, “there aren’t any investors writing checks”.

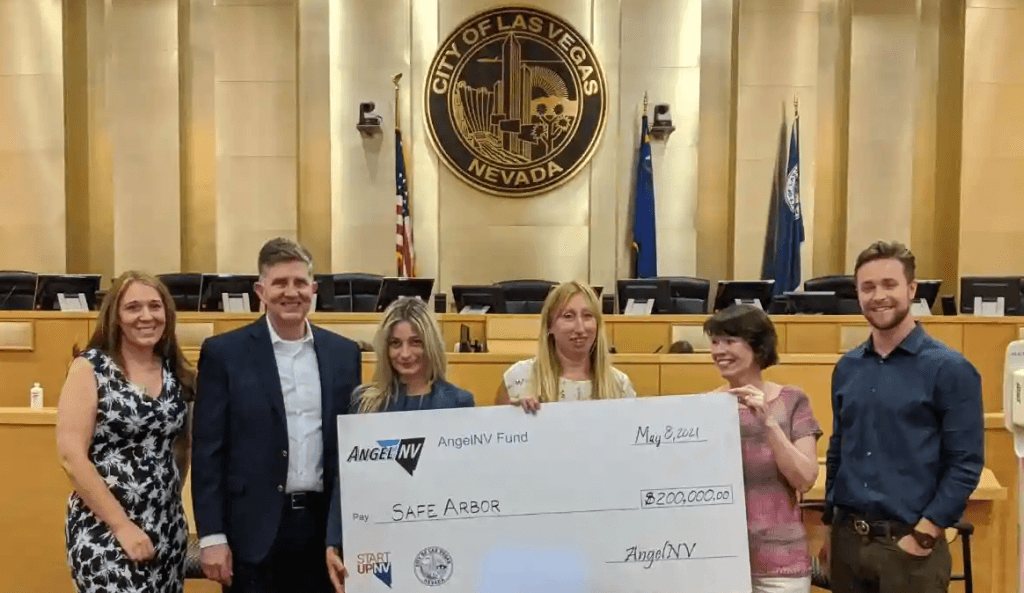

AngelNV improves both of these issues through two educational and event series – one series for founders and the other for angel investors. Some events in both series overlap – and both educational series conclude in a joint, one-day conference where at least 1 company is funded with $400,000 including $200,000 from investors participating in the angel series and a 1:1 match by the SSBCI program invested by the Battle Born Growth Ventures.

AngelNV is open to the public for any member of the community interested in learning more about starting a company or investing in a new business. Community members looking to invest must be considered an accredited investor.

AngelNV is building the Southern Nevada startup ecosystem by engaging seasoned and novice angel investors to learn and strengthen angel investing skills while providing access to deals from different industries and stages. A series of learn by doing events for investors build up to a one-day conference, and a 6-figure check for the winning entrepreneur.

The Las Vegas based Investor Track starts on January 10, 2026 and concludes on April 11, 2026. Schedule a time to chat with our Executive Director about participation, ask questions – or get more details online.o

Entrepreneurs attend free weekly Due Diligence sessions and receive coaching and feedback from the StartUpNV Team to ensure their startup is ready for investment, as they prepare to compete at the AngelNV “main event” on April 11, 2026. The Due Diligence bootcamp program began on September 30 for AngelNV 6. Registration is closed, and late registrants can catch up via recorded sessions.

Meet A Nevada Angel

Jeff is a six-time angel with the AngelNV Conference. Jeff has been leading the effort for StartupNV throughout Nevada – with loads of help from former Vegas Valley Angels and a burgeoning startup ecosystem in Las Vegas. Investors like Jeff have gone on to become involved with FundNV, the 1864 Fund, the Sierra Angels, and other investor groups.

Jeff Saling

StartUpNV

Earn Your Halo

- $5,500 total

- $5,000 of unit cost is invested.

- The remaining $500 tax-deductible donation is billed separately by StartUpNV (a 501c3 non-profit) and covers program operation costs, Nevada Blue Sky state fees, and fund set-up and administrative costs for the first 5 years of the fund (~ 7 years).

- Investors may attend bootcamp sessions as desired. Participation in group discussions may be restricted due to time constraints.

- Investors domiciled outside of Nevada may incur additional blue sky fees for their states ($300 to $500 for most states)

- Fees also include access to AngelNV Investing Bootcamp, ACA Membership, and one (1) finale event ticket.

Sessions & Dates

AngelNV Investor Bootcamp 2026 | ||

| January 10 | Basics of Angel Investing | |

| January 13, 20 and January 27 | Intro to Dealum, reviewing companies, culling to 16 | |

| February 3 | 3 minute pitches | |

| February 10 | Discussion to get to 12 companies | |

| February 17 | 10 minute pitches | |

| February 19 | 10 Minute pitches | |

| February 24 | Due Diligence discussion to get to 6 Finalists | |

| March 3 | DD | |

| March 10 | DD | |

| March 17 | DD | |

| March 24 | DD | |

| March 31 | DD | |

| Monday April 6 | DD Reports Due | |

| April 7 | Straw Poll | |

| April 11 | Finale | Las Vegas City Hall 1 to 4 pm |

Sponsors